Earnings Update: YuHua Education (6169.HK)

Blow-out earnings report significantly improves our conviction.

This earnings update should be read in conjunction with my original deep dive.

Quick Take

YuHua Education pre-filed their interim report with the Hong Kong exchange after the bell on April 30th. The report significantly beat my bearish expectations, with top-line growth exceeding 7% year-over-year and gross margins improving by more than 900bps. Y/y EPS was up 110% for the period. The MD&A cited recent cost discipline as the primary driver of earnings growth, but also noted that growth in students had some impact due to fixed cost leverage. Management stated that cost controls will be a priority going forward.

Equally as surprising, YuHua chose to meaningfully deleverage, reducing its domestic bank loans by 65%. The stock is now, more or less, debt-free. No explanation was provided on why management made this decision, but we believe it’s a prudent move to rebuild investor confidence.

Finally, capex accelerated sequentially but remains well below peak levels from a year ago. We’ll need to wait for the full interim filing in May to confirm whether new capex is going into capacity increases or further renovations, but we strongly suspect it will be the former, e.g., investment for growth rather than catch-up spending from neglect.

With recent CCP site visits out of the way and the convertible restructuring ugliness behind them, YuHua appears poised to get back to business as usual. The final piece of the puzzle will be reinstatement of the dividend.

Below, we’ll get into some more granular updates on these points.

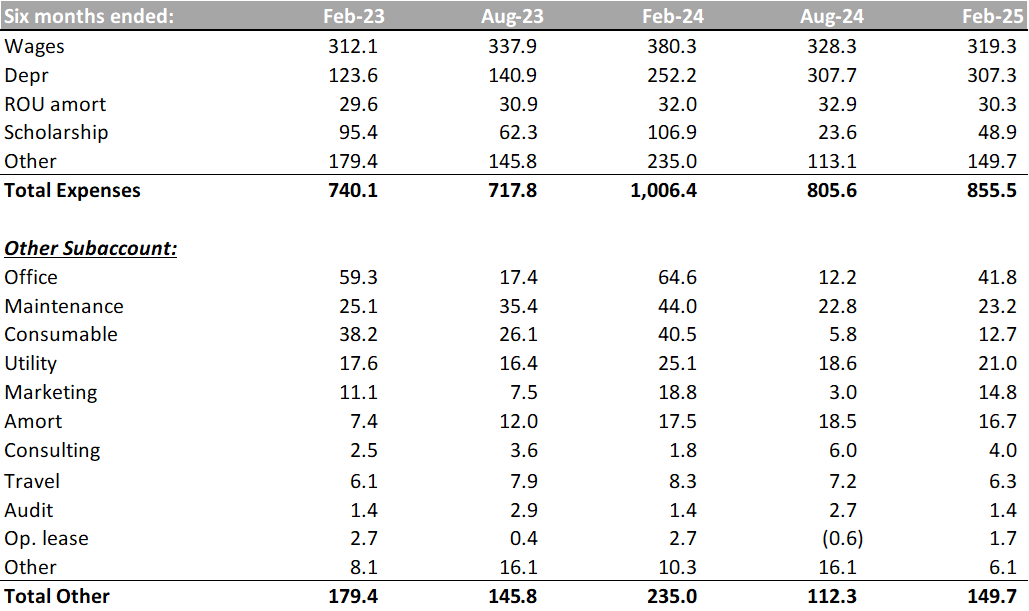

Expense Sub-Account Review

The big story here is cost controls leading to meaningfully improved margins. Let’s dig in a bit on what levers were pulled.

Total cost declined by CNY 140m y/y and CNY 50m sequentially. Y/y declines were led by wage decreases, declines in maintenance and office costs, and a reduction of scholarship expense.

Of these, we think maintenance, office, and wage declines are sustainable. We are left to speculate, but we believe that YuHua temporarily overstaffed admin and maintenance workers to spruce up the school and expedite the cleanup of dated back-office processes in preparation for the CCP site visit. The data supports this, as shown below.

Note the substantial spike in total employees, commensurate with the CCP's reform announcements. The number of employees per student far exceeded my expected student-employee ratio, indicating an imbalance in "Other” employees, such as administrators, maintenance staff, and janitors.

If we assume a 16:1 student-teacher ratio, this would imply approximately 7,000 teachers on staff today. In addition, YuHua has consistently retained 300 corporate-level workers. This means there are ~1,500 “Other” employees. Run-rate levels should be ~1,200. In other words, wages should be flat to down next semester and grow at roughly the rate of inflation thereafter.

Scholarship expense declines are less explainable, and we think the expense might pop back up. To be safe, we’ll assume this comes back in full.

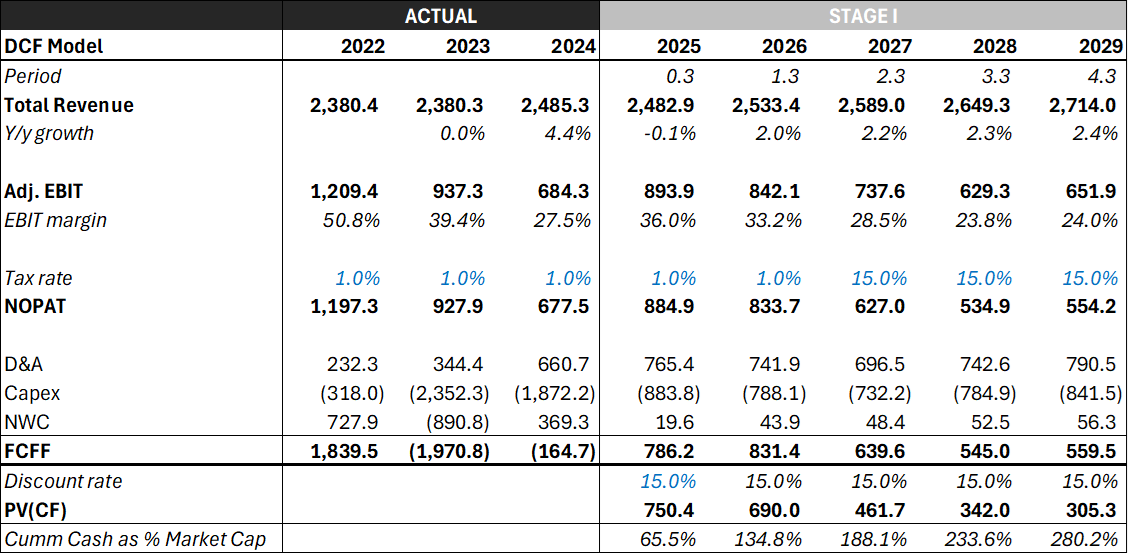

Valuation Revisions & Review

Our initial hope was y/y gross margin stabilization and minimal decline in revenue, driven by (a) Thai subsidiary derecognition, (b) inability to raise tuition, and (c) fully utilized capacity at universities restricting organic growth. It now seems clear that we were overly bearish across the board.

We’ve tweaked our forward estimates in the following ways:

We are revising our full-year ‘25 revenue estimate from -3% to 0%. Implied growth is 2.5% based on the February print, but we remain skeptical.

Initially, we expected margin stabilization at the c.35% level through 2029. We now believe full-year ‘25 margins will be 48%.

Even if tuition caps are put in place, from this higher base, fixed cost deleveraging should allow for margins >35% for the next few years. We are targeting a FY26 GPM of 45% and FY27 of 40%. We will hold FY28 and ‘29 at the 35% level.

Given these changes, our ‘25 EPS estimate is now CNY 0.20 (Prior: 0.13) and FY26 is CNY 0.19 (Prior: 0.12). Below we’ve included a revised valuation model.

Wrapping Up

We believe this earnings print was a huge victory for the stock. When investing in these optionality-type plays, it feels like you’re more often surprised to the downside than the upside, so it’s just great to get such a robust (and pleasant) beat to conservative estimates. The stock hasn’t started trading yet, so we’ll see how the market reacts, but we think it should be quite positive. The stock is illiquid and underfollowed, so it may take a few days for results to trickle through the system. We’ll be keeping a close eye on the reaction and volumes to try to gauge whether any institutional buyers are interested yet. Regardless of price action, we now feel significantly better about our ownership in the name and intend to incrementally add to the position.

Please leave any feedback, comments, or pushback in the comment section. You can also find me on X @cornerstone127. Write-up suggestions welcome!

If you enjoyed this and want more of this type of content, please subscribe below. Also, be sure to share with friends, family, and colleagues. Thank you for reading!

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your own due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclaimer: As of the time of writing, the author owns shares in the company described in this article. The author may purchase or dispose of these shares at any time without notice.

Do you have the name of school waiting to convert to for-profit and do you know why the board waiting for profit approved and then they can announce dividened?