Liberty Broadband (LBRDK.US): The Most Complex Simplification Story

A classic eye-wateringly complicated John Malone tracking company is finally having its day of reckoning. Value will be unlocked.

Quick Notes

Liberty Broadband (NYSE: LBRDK) is a complex John Malone Holdco whose primary asset is a 28.5% stake in publically traded Charter Communications (NYSE: CHTR).

LBRDK has traded at a persistent discount to NAV due to complexity, uncertainty around taxes, and lack of visibility on the rationalization of the Holdco structure.

On November 13, 2024, Charter and Liberty finalized deal terms that ensured the Holdco would be wound down by June 2027.

LBRDK now trades at a c.15% discount to merger NAV with a guarantee that this discount will collapse in the next 18 months, if not sooner. Further juicing returns, CHTR itself appears to be trading at a meaningful discount to intrinsic value, providing fundamental support and upside to the transaction.

Thesis Summary

Liberty Broadband (“LBRD”) is a Holdco comprised of a 28.5% ownership of publicly traded Charter Communications, 100% ownership of dominant Alaskan telco and cable company GCI, and an attractive debt stack of busted converts and low interest preferred. LBRD has persistently traded at a 15 - 40% NAV discount, but this will soon be resolved as a recent all-stock merger struck with Charter in November 2024 has finalized terms of rationalizing the structure. Per the merger terms, on or before June 2027, LBRD shareholders will see their shares convert into CHTR stock at a 0.236 CHTR:LBRD ratio. In addition to receiving 0.236 CHTR shares, LBRD shareholders will also receive GCI as a standalone entity via a pre-merger spin transaction with spin-related taxes covered by Charter up to $420M. Charter will assume or retire LBRD’s group-level debt as part of the Holdco collapse.

Under the merger terms, LBRD trades at an attractive 15% NAV discount, implying a 10% annualized IRR to LBRD shareholders over the next 18 months. We suspect some combination of an accelerated merger consummation, interim period LBRD share buybacks, and underlying CHTR stock price appreciation will juice IRR math during the hold period.

While LBRD trades at a 15% discount to today’s CHTR price, a review of Charter shares reveals that the cable company is likely itself undervalued at 8.5x NTM P/E. Accounting for our estimated 40% upside to CHTR’s stock price, LBRD trades at a healthy 35%+ discount to the adjusted merger NAV, or 60% upside from current levels.

We see LBRD as a “heads I win; tails you lose” dynamic. Investors win in an accelerated merger scenario, win in a protracted merger scenario, and win on a fundamental CHTR re-rate, which we view as more likely than not to materialize. We believe negative investor sentiment around Charter Communications is bleeding into LBRD’s valuation and that complex merger terms and a far-off merger date are leaving the stock largely in limbo.

Recent Events

September 15th, 2024, Charter proposed to purchase LBRD at an exchange ratio of 0.228x, conditional on the disposal of GCI.

September 23rd, 2024, LBRD counteroffered a 0.290x exchange ratio, stipulating that GCI would be included in the exchange.

November 13th, 2024, CHTR and LBRD reached a definitive merger agreement specifying a 0.236x exchange ratio contingent on the disposal of GCI before the merger given that CHTR would foot the GCI spin-related tax bill.

Why Does This Opportunity Exist?

Misunderstanding of GCI. LBRD trades at an 8% discount to CHTR shares alone before crediting GCI. We estimate GCI is worth $5 - $10 per share and believe the asset is a well-positioned, dominant telco in its market. We think investors don’t understand this business and don’t appreciate the value that the spin will unlock. Thus, they see it as a “bonus” to the merger rather than a valuable asset to shareholders.

Poor Sentiment Around Cable. Charter’s valuation has been pummelled over the last few years as the industry faces sweeping disruptions. Chord cutting has accelerated, and new market entrants are slowing legacy broadband internet subscriber growth. While these fears are, to some extent, founded, we suspect they are overblown relative to the actual risks, creating a fundamental mispricing in the underlying.

Complexity. The CHTR-LBRD merger is complex and long-dated, and LBRD’s structure is also complex. Further, the long-dated merger has encouraged analysts to postpone their review of the business. In short, we think many analysts haven’t sat down to the work yet and believe there is an opportunity to front-run merger arb traders.

Business History

Liberty Broadband is one of the many vestiges of John Malone’s Liberty Media empire. LBRD has been a long-standing vehicle created initially to isolate Liberty’s Charter ownership and later as a home for Liberty’s Alaskan telco, GCI. Several idiosyncrasies within the LBRD vehicle have long made it difficult to analyze (e.g., multiple share classes, complex debt instruments, and opaque tax liabilities). Long-time followers of Malone’s escapades will be familiar with LBRD’s brand of complex antics and financial engineering. For readers less familiar, I highly recommend picking up a copy of Cable Cowboys. It’s a fascinating read that reviews Malone’s storied history in legacy media and will provide context to the type of shenanigans that have made Liberty so famous.

Below is a brief summary of Liberty Broadband’s development as a standalone entity:

Liberty Media first invested in Charter in 2013 when the firm purchased 27.3% of the company from a consortium of private investors.

In November 2014, Liberty Broadband was spun from Liberty Media to isolate the Charter shares and provide investors with a clearer understanding of the asset’s value.

In May 2016, Liberty Broadband orchestrated a merger with Charter, TWC, and Brighthouse. This merger effectively created Charter Comms as we know it today.

In December 2020, Liberty GCI merged with Liberty Broadband in an all-stock deal. The merger with GCI simplified the broader Liberty Media structure but muddied the waters for Liberty Broadband’s financials.

Peppered throughout LBRD’s history has been Malone’s signature financial engineering. LBRD has persistently traded at a discount to NAV. In response, Malone has spent most of LBRD’s lifetime exploiting this discount through creative financing. In fact, the LBRD debt stack arose primarily through creative ways of arbitraging the NAV gap. Is the discount between LBRD and Charter too wide? Perhaps take a margin loan against the CHTR shares and use the proceeds for LBRD buybacks. In a handful of particularly well-designed maneuvers, LBRD issued convertible debentures against CHTR at elevated multiples and extended NAV discounts and used the debt proceeds to accelerate the buy-in of LBRD shares. As CHTR fell and the discount widened, LBRD refinanced the notes at a discount to par and bought even more shares. Alongside creative financing, LBRD has also been a routine seller of CHTR shares, with proceeds plowed into accretive buybacks.

Charter Communications: High-quality business trading at a discount

Charter Communications is one the most dominant broadband internet providers in the United States. The firm controls 28% of broadband infrastructure and serves 30M+ internet customers nationwide via the Spectrum brand. In addition to high-speed internet services, CHTR also provides cell service, landlines, and legacy cable TV to millions of additional subscribers. Although Charter’s broadband internet offering has increasingly faced competition from new technologies, for much of the U.S., Charter’s legacy HFC (Hybrid Fiber-Coaxial) network remains the best, cheapest, and often only option for internet services. The critical infrastructure footprint Charter controls is an enormous, long-lived asset to the firm that would cost tens of billions, perhaps hundreds of billions, of dollars to replicate today.

Due to the high cost of entry, CHTR operates with a substantial moat around its services and generally enjoys a monopolistic or duopolistic position within its regional submarkets. CHTR leverages these strong regional positions into robust margins as new broadband subs come onto the network at incredibly high incremental EBIT. Cable infrastructure is long-lived, and we believe a substantial portion of CHTR’s infrastructure will outlive (or has already outlived) its depreciable life, leading to long-term annuity-like income at a generally increasing EBIT margin over the life of the asset.

Perhaps somewhat surprisingly, CHTR has been a secular growth story for the past 10 years. The company has invested heavily in rural internet buildout and has seen excellent ARPU growth and margin expansion as customers shifted from lower-margin cable TV packages to high-margin cable internet bundles. Through its pivot to broadband internet, CHTR has effectively transformed itself from a legacy media player into a major critical infrastructure firm that has been a broad beneficiary of the increasing need for connectivity across America. As a stark example of this transformation, we estimate that legacy cable TV packages may be run at roughly EBIT breakeven with their primary purpose to firm as a bonus for internet bundling in an attempt to create stickier subscribers, reducing lifetime customer churn. Bearing this in mind, we want to take a moment to emphasize our belief that legacy cable TV sub decline is largely a red herring for investors as the business's broadband internet and growing wireless services will be the primary dictators of future growth and profitability.

For the better part of the last decade, the stock has produced solid MSD% top-line growth, with 25bps or more in EBITDA expansion per year, thanks to a favorable revenue mix shift and operating leverage afforded by broadband infrastructure. While cable subscribers have been in secular decline for 5+ years, pricing power has remained extremely strong for the service and has more than offset chord cutting until recent quarters. We believe cable declines will create 25 - 75 bps of top-line headwind over the next few years, after which declines will be de minimis relative to group revenues. Interestingly, we expect margin declines in the cable TV segment to be EBITDA margin accretive to the broader group.

Despite robust business characteristics, CHTR has faced a number of operational challenges over the past few years. COVID and COVID-era policies were once a significant tailwind as they created meaningful demand pull forward. A major contributor to this pull forward was the Affordable Connectivity Program, or ACP, a stop-gap subsidy measure designed to provide low-income consumers access to broadband internet during lockdowns. Today, COVID tailwinds have shifted to headwinds, as broadband internet penetration has essentially hit saturation, leading to a slowdown in industry growth. Further, the roll-off of ACP subsidies in June 2024 has driven elevated churn in broadband over the past few quarters, which has hit Charter particularly hard since they leaned into subsidy participation heavier than competitors such as Comcast.

On top of general market dynamics worsening, competition in the broadband space has intensified significantly in recent years. First, fiber overbuilders (Lumen, Altice, AT&T, Verizon, and others) have leaned into the costly process of ripping out old dial-up lines and replacing them with ultra-high-speed fiber optic cables. Fiber projects are hitting the densest urban areas hardest, as overbuilders need to reach significant penetration to achieve a return on costly buildout, which brings key Charter markets under threat of competition. Overbuilders are also offering aggressive debt-subsidized promotional packages to try to rapidly take market share, which has sent some sub-markets into a price war tailspin (previously unthinkable under the old HFC broadband regime).

More alarmingly, Verizon and T-Mobile have begun packaging their excess 5G/LTE data into fixed wireless broadband internet for the home (e.g., FWA packages). Initially dismissed by market participants as a passing trend, FWA has borne out to be much more popular and stickier than expected. FWA is cheaper than HFC broadband, and speed and reliability have proven sufficient for many consumers. Although many industry analysts have pointed out that telcos have limited spare bandwidth, judging by the growth rates and language from management teams, capacity constraints are much less of a concern than the market initially thought.

Given that today’s broadband market is effectively fully saturated, advances in new technologies such as FWA necessarily imply market share loss for incumbents such as Charter. FWA and Fiber continue to grow at an alarming clip, which has called into question the sustainability of Charter's broadband subscriber growth. Only a few years ago, the stock traded at rich multiples implying an unstoppable and secular growth story. Today, the name has been left for dead and trades at a dumpster HSD multiples across the board. With increased overbuilding and low-cost wireless options eroding Charter’s ability to win price-sensitive and rural customers, markets worry that Charter’s broadband crown jewel will become a melting ice cube.

While we admit this is a dour backdrop, we think market participants are failing to see the forest for the trees. Charter has become a popular whipping boy for pod shops interested in trading around earnings revisions driven by broadband subscriber misses. Meanwhile, the sell side struggles to recommend the stock due to a lack of near-term visibility given FWA’s rise and ACP roll-off.

Setting all this aside, CHTR trades at <9.0x NTM P/E and is a dominant infrastructure player with millions of customers. CHTR provides an excellent value offering due to its converged product services and bundling. Even modeling minimal go-forward broadband sub growth and highly punitive cable TV sub losses, we believe 1.5% - 2.5% p.a. topline growth is easily attainable over the next five to ten years.

From a competition standpoint, while it's hard to say when FWA will level off, we think it’s clear that fixed wireless subscribers can’t grow forever. Excess spectrum is limited for the telcos, and even if it wasn’t, the product only appeals to a niche price-sensitive customer. On the opposite end of the spectrum, fiber may offer near limitless symmetric up-down speeds, but as we start hitting 3, 5, or 10 Gbps, consumers aren’t able to tell the difference. Charter is rolling out its DOCSIS4.0 upgrade across the legacy network, which will provide consumers with internet speeds well beyond their utilization ability and, in theory, undifferentiable to Fiber offerings.

Further solidifying the firm’s value-add, Charter can offer meaningful discounts to customers based on bundling. We think the company’s converged product offering (internet + wireless + TV) offers an extremely compelling and difficult-to-replicate value to consumers that can translate into meaningful cost savings and, ultimately, much stickier subscriber relationships.

All in all, we believe investors need to grit their teeth and endure the short-term volatility. Charter’s trading price has been driven down due to near-term uncertainty and a few weak quarters. Looking ahead, once we lap the ACP roll-off, start to see FWA finding its limit, and allow for CHTR’s wireless business to achieve more significant scale, we think Charter’s sub counts will stabilize, and the stock can return to LSD% top-line growth with meaningful margin expansion.

GCI Communications: Currently unpriced by the market

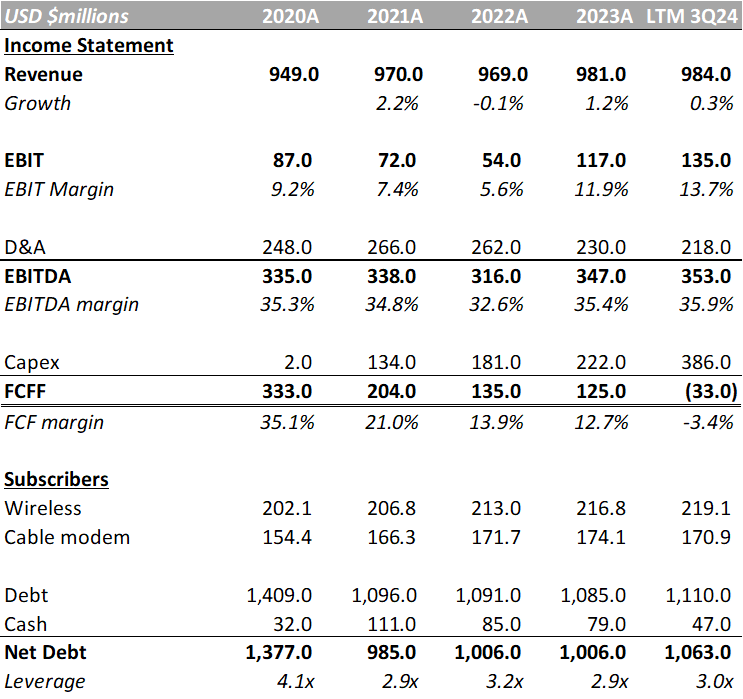

GCI, Alaska’s premier broadband and telecoms company, is a unique asset that has been discussed little since its merger into the LBRD structure in 2020 and, frankly, saw limited discussion even before as a standalone business. LBRD, for its part, has maintained excellent reporting standards around GCI, which has allowed for detailed analysis over the duration of the firm’s life. Despite robust disclosures, limited analysis appears to have been done as GCI’s value has been vastly overshadowed by the CHTR shares, and many investors have been happy to accept it as a free kicker while focusing primarily on the CHTR-LBRD NAV gap. Despite little fanfare, GCI has demonstrated itself to be a market-leading duopolist with an enormous share in the Alaskan market.

Alaska is a rather undynamic low-to-no-growth market. The Alaskan population has seen minimal growth over the past decade. Communities across the state tend to be extremely small and rural, with limited access to critical infrastructure and services outside of Anchorage. Against this backdrop, GCI has carved out a near monopolist position in many areas across the state through legacy broadband infrastructure and buildout on the margin funded by government subsidies. GCI has ultra high-speed internet passing across ~80% of the state and high-speed broadband passing across 90%+. The company clips stable 36% EBITDA margins and shows a healthy 15 - 20% FCF margin on no-growth capex levels.

The firm maintains ~200K wireless customers and ~156K cable internet subs. U.S. Census Data indicates that Alaska has only 267K households and ~645K persons aged ten years or older. This implies a 50%+ broadband share and c.33% wireless share. GCI’s only real competitor in the state is AT&T, which primarily competes in Anchorage and Fairbanks.

In short, while GCI may have limited growth opportunities, we find its market position challenging to replicate. We believe GCI has ample pricing power, some room to grow through government subsidies, and an extremely wide moat in its niche.

Misc. Merger Notes

Merger Timeline

The merger must be consummated by June 30th, 2027, at the latest. The merger can occur sooner than this date, and we highly suspect both parties would like to accelerate the process. So why is the deal dated out so far? We think the primary reason is that GCI needs to be prepped for its spin-off. We think LBRD believed GCI would go with Charter during the merger and that there may be significant work to prep the company for floatation. Once the spin occurs, we expect to see the merger consummate rapidly.

Stock Options

There is quite a pile of out-of-the-money stock options outstanding on LBRD shares. OTM LBRD options will be restruck as CHTR options with a new strike price equivalent to the current strike on LBRD (e.g., restruck based on exchange ratio). This is good news for shareholders, as options represented a potential 2.9% dilution if converted.

GCI Spin-off

GCI will be spun off to shareholders before the merger date. The spin is a taxable event, but CHTR has agreed to cover taxes up to $420M. We believe this amount should fully cover the tax burden for shareholders. However, there is a risk that LBRD will bear any excess tax liability.

Interim Share Repurchases & Debt Retirement

Per the merger terms, Charter is obligated to repurchase $100M CHTR shares per month from LBRD until the merger is consummated. LBRD is required to use these proceeds to reduce debt. Management has indicated that stock sale proceeds directed toward debt reduction will be tax-free.

Valuation

We will employ an SOTP valuation to build into LBRDK’s value.

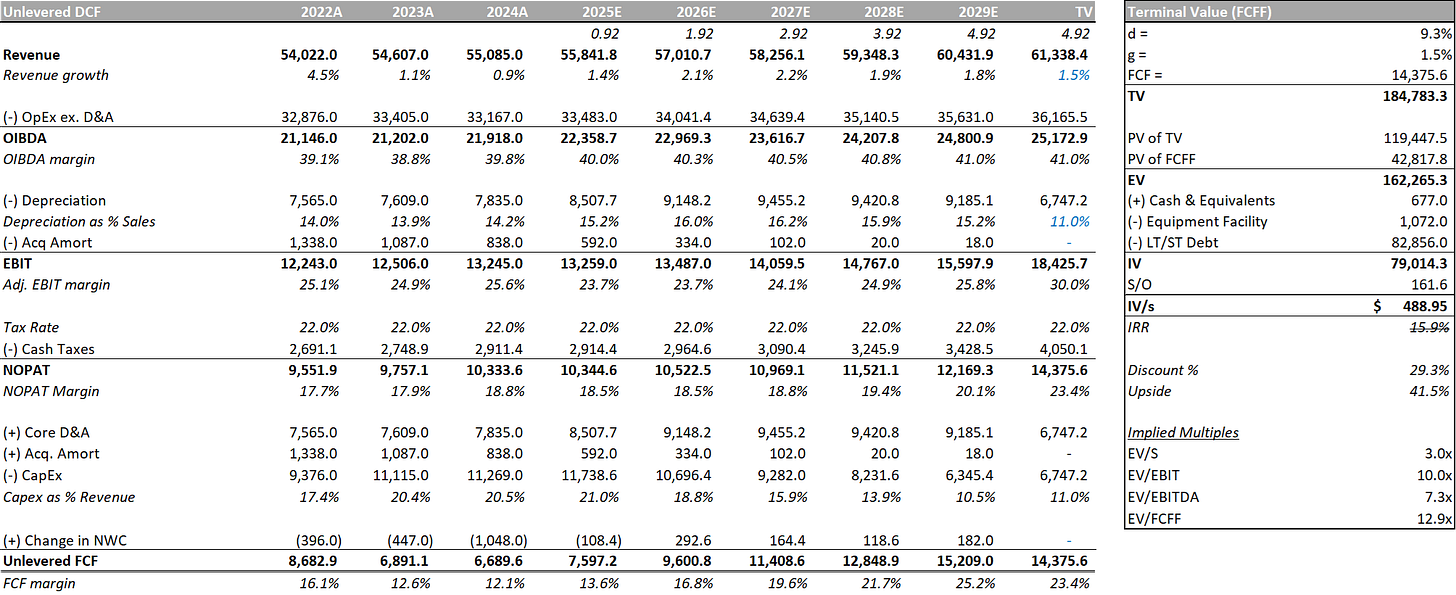

Charter Communication Valuation

We forecast FY25 - FY29 explicitly capturing the ramp-up and down of the current rural buildout and DOCSIS4.0 upgrade cycle. In our terminal year, we move Charter to “equilibrium” capex which we estimate to be 11% capex/depreciation as % sales.

Note that we view growth as challenged for the company going forward fixing top-line at +1.5% p.a. (GDP minus) in the long-term. We think this accurately reflects future broadband competitive dynamics.

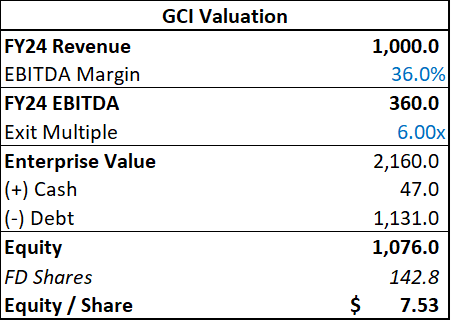

GCI Valuation

GCI is a straightforward business. Revenue should exhibit 1 - 2% run-rate growth, and EBITDA margins are essentially stable. Based on market share and growth opps, cable and telcos have historically traded in a 6 - 8x EBITDA range. We’ll use the bottom of the trading range for conservatism even though we see GCI as worth a roughly middle-of-the-pack multiple given its dominance.

Sensitivity analysis around margin and multiple:

LBRDK Valuation Build-up

LBRDK trades at a healthy NAV discount on the current CHTR price. When accounting for CHTR's intrinsic value, the discount widens significantly, providing a healthy upside to shareholders.

We are ignoring LBRDK's group-level debt (convertible debentures, margin loans, and preferred shares), as CHTR will eliminate these during the merger.

Key Risks

Tax obligations. The GCI spin will be a taxable event; however, Charter will cover up to $420M in taxes, with any excess borne by GCI shareholders. Additionally, any issue in the RMT transaction may leave LBRD shareholders with a significant tax burden.

Charter valuation. The LBRD thesis is contingent on the underlying CHTR valuation. A fundamental deterioration in CHTR will dominate the LBRD shareholder return. This risk cannot be isolated as hedging CHTR is prohibitively expensive given the 18-month merger duration. This likely partially explains the elevated merger arb discount.

Merger delays and breakage. As with any merger deal, particularly one with such a distant date, delays and breaks can ruin the trading dynamics.

Catalysts

Consummation of merger. Ultimately, this is a midterm thesis in which value is unlocked as the NAV discount collapses during the merger.

GCI Spin. We believe the GCI spin will unlock meaningful shareholder value by significantly simplifying the story. Moreover, we believe the market assigns GCI close to zero value, and as such, its distribution will have no impact on LBRD’s stock price, effectively gifting value to shareholders of record.

CHTR Fundamental Improvement. A re-rate in CHTR stock is pari passu to a re-rate in LBRD. CHTR has a number of fundamental drivers. We believe chief catalysts will be the re-acceleration of broadband subs, discipline on capex, and a position of strength on buybacks.

Conclusion

Liberty Broadband offers investors an interesting risk-reward dynamic. Mid-term merger dynamics and the potential to roll up the NAV gap as the merger date approaches should yield reasonable risk-adjusted returns. Longer-term, LBRD is a much cleaner way to own a dominant broadband asset, Charter Communications, at an attractive entry point. Charter trades at <9x P/E, further discounted to <8x on a pass-through basis when owned via LBRD.

The transaction's complexity and 18-month time horizon are keeping larger market participants on the sidelines for now. However, this can’t last forever, and as we approach June 2027, malaise should naturally dissipate, tightening deal spreads. We believe there is an opportunity for an accelerated value unlock if either GCI is spun early or the merger deal is consummated sooner than anticipated.

One final thought we’ll leave readers with. Charter and Liberty Broadband shareholder registers are very attractive. While we wouldn’t base an investment case around other people’s ownership, we appreciate that we are in good company. On the Charter side, a litany of value investing mainstays appear in the top shareholder ranks. Oakmark Funds, Dodge & Cox, Pzena, Ruane Goldfarb, and Berkshire Hathaway are all prominent shareholders. Liberty Broadband counts many the same investors, in addition to significant skin in the game from John Malone and Malone’s prodigy Greg Maffei as well as a supporting cast of elite activist and event-driven investors, most notably Elliott and Farallon Capital. This is an astonishingly concentrated roster of top-tier asset allocators, many of whom we suspect are unlikely to sit by idly for 18 months.

Please leave any feedback, comments, or pushback in the comment section. You can also find me on X @cornerstone127. Write-up suggestions welcome!

If you enjoyed this and want more of this type of content, please subscribe below. Also, be sure to share with friends, family, and colleagues. Thank you for reading!

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your own due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclaimer: As of the time of writing, the author owns shares in the company described in this article. The author may purchase or dispose of these shares at any time without notice.

I want to pre-emptively head off some questions about LBRDK volatility over the past week.

On 1/30, Comcast reported worse than expected broadband sub losses which implied that Charter Comms would likely also report weak subs. This drove Charter shares lower and, since LBRDK trades at a circa 1.0x CHTR beta, LBRDK shares followed suit.

The next day, CHTR release earnings and broadband subs were actually pretty stable, so LBRDK/CHTR caught a bid. Commentary from management was so-so in the call (capex still higher than I’d like), so things leveled out over the day.

At it currently stands, broadband sub expectations are probably suitably de-risked going into Q1. CHTR seems to be holding up better than CMCSA on the broadband front although both are noticeably weaker than last year. CMCSA is a far more complicated story to be fair and really understanding each piece of that monstrosity is beyond the scope of my knowledge.

The number one thing to watch from here will be broadband net additions quarter to quarter. If additions come in weak, that will spell deep trouble. If we can see some adds in the next few quarters, expect a lot of upside in the name. The rub here is that we probably need three to four quarters of broadband figures before we can sound any real alarm bells on FWA/Fiber.

For reader reference, I’m modeling CHTR at flat net additions in FY25 and reacceleration into FY26. Its not clear to me if that’s above or below buy-side consensus.

I’ll probably do a standalone CHTR deep dive at some point in the future. I also need to (shiver) review CMCSA further given the spin transaction. Definitely expect me to keep this analysis hot as this is a pretty polarizing and volatile situation.

Excellent piece! I learned a lot about the history of Liberty and Charter. I’ve seen this name for quite a while float among the 13fs of funds I follow but never fully understood the story. Your analysis and story telling blend the full picture beautifully. Thanks for sharing!