Neogen (NEOG.US): Busted M&A Play Nearing Inflection

High insider buying, strategic divestiture, and roll-off of one-time headwinds all indicate significant opportunity for near term inflection.

Base Case & Quick Notes

For decades, Neogen (“NEOG”) was a GARP investor’s dream, delivering 19,000% TSR over thirty years for a 19% CAGR through 2021.

In 2022, this all changed as the firm undertook an ill-conceived transformative merger that destabilized the business and led to an almost unprecedented multi-year fall from grace in its stock price.

In April 2025, after three years of abysmal performance, the company fired its CEO, cut guidance, and reported a weak print. The stock dropped 40% that day for a cumulative fall of 90%+ from its pre-merger price.

Although the price action looks dire, we believe reality is rosier than it appears, as NEOG’s core business is intact and growing. Further, we think NEOG is only a few quarters away from a pivotal inflection in its earnings.

At 11x normalized P/E, we think this is a heavily discounted high-quality compounder nearing inflection in its turnaround story.

Thesis Summary

Neogen (“NEOG”) is a market-leading food safety firm undergoing significant operational hardship due to a failed transformative merger, legacy business restructuring, and a series of unfortunate macro headwinds. Following a protracted series of executional missteps, investors have essentially left the stock for dead, driving the price down 85% over the past three years. Although the situation appears dire, we believe NEOG’s fundamentally attractive business remains not only intact but growing. Further, NEOG has several near-term catalysts that we believe will drive a material re-rate over the next 12 – 24 months as the business moves past operational issues and unmasks core growth. Even assuming a modest re-rate (our base case), NEOG can deliver 85% upside over the next two years as issues abate and investors regain confidence. At <11x FY27 P/E, we view NEOG as an excellent opportunity to own a high-quality compounder in a secular growth industry at heavily discounted valuations.

Recent Events

December 2021. NEOG and 3M announced their intent to merge 3M’s Food Safety Division (FSD) with NEOG in a complex multi-year carve-out transaction via a cash-and-equity deal.

January 2022. Stock falls 20% in a month as the market worries about deal complexity, dilution, post-merger dependence on 3M, and required debt.

September 2022. The CFO resigns, and the 3M merger is executed. At this point, the stock has fallen 60%+ since the deal announcement.

March 2025. The COO resigns after ERP and product line launch failures.

April 2025. CEO John Adent fired by the Board. Guidance cut again due to “bad macro.” NEOG’s price falls 40% for a cumulative 90%+ drawdown.

Why Does This Opportunity Exist?

Market Pessimism. NEOG has had protracted stock price and business underperformance. Recent disappointing results, combined with tariff fears, have created a disconnect in the price.

Opaque Performance. It isn't easy to understand why this business is so strong, and unadjusted financials screen terribly. Getting comfortable with the business is mosaic and qualitative.

Dislocated Investor Base. GARP long-only investors historically owned NEOG, bidding it up to unsustainable multiples. These shops puked out the stock, but it wasn’t cheap enough until recently to attract value investors.

Business Summary

Lansing, MI-based Neogen is a market-leading food safety company offering a comprehensive range of SKUs that touch all nodes in the food production value chain. Core products include bacterial testing, sample handling, veterinary instruments, culture media, and genomic services. NEOG has historically been a high-quality compounder delivering excellent ROICs, consistent HSD organic growth, and a tremendous TSR. The stock appreciated 19,000% from Dec. ’91 – Dec ’21, supported by a robust 5 – 10% p.a. organic growth rate, augmented by accretive tuck-ins. For years, the firm operated debt-free, required little incremental capital investment, and ran at low dilution.

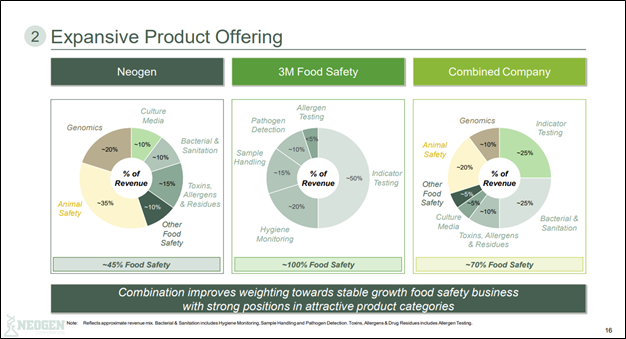

In December 2021, Neogen substantially diverged from its historic organic growth and bolt-on strategy by announcing a complex transformative merger with 3M’s Food Safety Division via a multi-year carve-out deal following a split-off RMT transaction. The equity-and-cash deal was worth more than its pre-merger EV and required significant operational restructuring on NEOG’s part. The resultant entity was (and is) the largest food safety company in the world with ~$900m in run-rate revenue. Legacy NEOG shareholders retained 49.9% of the equity, while 3M FSD tender holders[1] received the rest. NEOG also paid a $1bn cash dividend to 3M, financed with fresh debt, resulting in a 3.0x net debt leverage ratio.

Standalone 3M FSD had been a robust acyclical business with secular growth characteristics rivaling NEOG's. Its crown jewel product, Petrifilm, an agar petri dish replacement, has c.95% market share and 50%+ incremental margins. The product is a razor-and-razor-blade model that routinely delivers HSD to MDD growth and faces virtually no market competition despite being off patent for many years. Additionally, FSD has a successful LAMP ATP test and a high-margin sample collection franchise.

Post-merger, Neogen’s combined portfolio is enviable. It is comprehensively positioned, 95%+ recurring revenue, and globally diversified. The food safety industry is well-positioned to continue global secular growth as food safety regulations, consumer interest, and global population drive TAM expansion. Importantly, NEOG is in an excellent spot to capture the growing market opportunity given its strong global footprint and brand portfolio.

The last few years, though, have far from demonstrated this as NEOG’s stock price was hammered pre- and post-merger due to PMI complexity, numerous self-inflicted problems, and macro headwinds that have cast doubt on the company’s ability to operate at scale.

Merger Integrations: An Unmitigated Disaster

Since 2022, NEOG has faced numerous operational challenges related to post-merger integrations. Issues boil down to three key areas: (a) 3M actively mishandled its unit divestment and ongoing partnership role, (b) poor merger integrations created several major operational missteps, and (c) Legacy NEOG has required restructuring and catch-up investment beyond initial expectations which has created meaningful operating drag over the last few years. On top of these issues, NEOG has faced FX headwinds and tariff-related impacts that eroded top and bottom line, further worsening the market's loss of confidence.

3M Partnership Issues

Between merger announcement and closure, FSD’s margins deteriorated by 700 bps, and topline stalled. 3M insiders and NEOG management have stated that 3M, struggling with COVID-related logistics and supply chain issues, deprioritized FSD shipments and reallocated raw materials away from the business once the merger closed. This created a significant undersupply in FSD’s main product lines, damaging operations. Further, 3M neglected to raise prices appropriately in its normal pricing cycle, ultimately leaving NEOG to inherit an upside-down cost structure in some products.

Post-divestment, 3M issues continued. FSD products had no dedicated manufacturing base, meaning NEOG has had to build multiple fresh production lines before in-housing FSD’s most important SKUs. 3M agreed to a four-year carve-out deal under which it would act as a contract manufacturer while Neogen built a dedicated FSD factory footprint. Early in the contract, 3M systematically under-delivered FSD products, prioritizing its own manufacturing needs over NEOG’s. This drove FSD share loss, frustrated customers, and created revenue headwinds, further exacerbating margin pressure.

Operational Missteps

3M refused to transfer its FSD ERP system to Neogen, meaning NEOG needed to set up its own system before bringing manufacturing and distribution of FSD in-house. This became a significant challenge as the Legacy entity had no unified ERP due to historic underinvestment in IT. Neogen scrambled to stand up a SAP ERP system, which they deployed 24 months into the merger in January 2024. Unfortunately, the rollout had major issues, resulting in shipping delays across the business that allowed a core competitor, Charm, to take market share from their allergen testing business.

On the heels of the ERP debacle, NEOG transferred the first FSD product line, Sample Collection, to their newly built facility. Production issues caused a failed product ramp, creating a significant backlog and further shipping delays that have obfuscated growth in other core products.

NEOG management has made a series of other blunders, including failure to manage working capital, repeated guidance misses, significant misestimation of post-merger margins, systematic pre-merger underinvestment in marketing, far overpaying for the 3M deal, and a failed attempt to force 3M employees to relocate to Lansing post-merger that threatened to create attrition in key personnel.

Legacy Restructuring & Integration Costs

On top of merger integration failures, Neogen has faced various integration and restructuring costs that have created sustained one-time or inorganic pressures over the past few years, including:

Downsizing non-core product lines and related inventory write-downs.

Construction of a new Michigan-based factory exceeding its initial capex budget.

Nine quarters of PMI costs average $5m per quarter or a 10% EBITDA headwind.

$10m in ERP stand-up costs spread over multiple quarters.

A $461m FSD goodwill impairment in 2Q25, essentially admitting to the market that they overpaid.

Adding more fuel to the fire, the Genomics sub-segment has significantly dragged growth and profitability. Historically, a MDD grower actively discussed on earnings calls, Genomics’ profile dramatically changed in 2022/23 as small animal genomics became commoditized, and COVID-19 era investment in companion animal genetics soured. Management began an aggressive exit of the business line in 1Q25. The business shrank 9% y/y with high decremental margins, creating a material headwind to earnings and revenue.

Macro Challenges

FX was a 6% revenue headwind in 2024 and a 3.4% headwind in the most recent quarter. Meanwhile, global inflation has created unprecedented softness in the historically acyclical food production end-market. In September 2024, NEOG’s specialty needles became subject to a 100% tariff. In the most recent quarter, Chinese food processors began moving away from U.S.-based companies. At the same time, distributors opted to draw down inventories in the face of macro uncertainty. These recent challenges triggered yet another guidance cut at the worst possible time, driving the stock down 40% in one day.

Inflection on the horizon

Although many investors seem to have thrown in the towel, we believe NEOG’s core business remains not only intact but growing. Revealing this growth requires significant qualitative research and careful examination of historic quarterly revenue sub-accounts. The most recent print showed unadjusted headline revenue growth of -3.4% y/y. Unpacking this, FX headwinds explain essentially all of this decline. On top of FX impact, ERP- and production-related issues drove an estimated ~$15m of additional headwind. Growth was further impaired by the dramatic decline in Genomics revenue and the closure of several legacy production lines. Taken together, we believe the core business grew 5% y/y versus -3.4% y/y as reported. This represents a massive disconnect in perception versus performance.

Extensive scuttlebutt research (piecing together scraps from transcripts, expert network interviews, competitor reviews, extensive line-by-line analysis of sub-accounts, and multiple conversations with Neogen) corroborates MSD core growth. This research paints a mosaic picture of a market-leading business with an excellent brand.

We believe underlying core business growth and profitability will be unveiled over the next 12 – 24 months as FX headwinds abate and the firm laps production and ERP issues. Fully ramped Sample Collection manufacturing should act as a tailwind as the firm works through an extensive order backlog. Management has indicated that they have pursued aggressive cost takeout for genomics over the past few quarters, which we believe is lagging relative to the revenue declines. On top of all this, headwinds in topline genomics and SKU rationalization will be less impactful in the future, given that genomics is a smaller portion of the business today and product line restructuring appears near completion.

From a profitability perspective, capex should renormalize towards maintenance levels by EOY26 as Neogen finishes its factory build-out and IT updates. At the same time, ERP and integration-related charges will dwindle. This will create a massive swing in FCF and margins, further juicing margin accretive reductions in non-core product lines and genomics.

Repositioning the business

NEOG has undertaken a strategic review of its non-core Animal Safety portfolio. We believe this makes a great deal of strategic sense and provides a self-help angle to the thesis. In April 2025, $60m in animal safety revenue was announced for divestment for gross proceeds of $130m. The team indicated another $70m of revenue is in late-stage discussions. Proceeds are earmarked for debt paydown, but IR has mentioned they are also open to share repurchases. These divestments will be margin accretive and benefit top-line organic growth as Food Safety has higher growth and profit than Animal Safety.

In addition to portfolio repositioning, management and governance overhauls are also underway. Per a May 14th 8-K, a “board refresh” is underway. The day before the 8-K filing, James Tobin, the chairman of the board since 2016, stepped down. In March 2025, Doug Jones, the firm’s COO, stepped aside. In the April earnings call, it was announced that long-time CEO John Adent was also asked to resign by the board. The May 14th update presentation notes that LTIP incentives are being reworked into “more performance-based equity grants.” Overall, we view all of these changes as positive, as we believe Mr. Adent and Mr. Jones’ decision-making was a major contributor to NEOG’s abysmal multi-year performance.

In the wake of these changes, insiders have bought the stock aggressively.

Valuation

Assumes renormalization by FY 2027, with the only residual adjustment being the add-back of acquisition-related amortization.

We are using a 20x exit P/E, which we believe is conservative as NEOG historically traded >35x avg LTM P/E, as have near comps.

Through the forecast period, we assume 100% of FCF is directed towards debt paydown as management works towards a <2.0x net debt level.

Pre-COVID / Pre-merger Multiples:

Summary Financials

Key Risks

Petrifilm Failure. The final major FSD merger integration is in-housing production of Petrifilm. Petrifilm accounts for 20% of NEOG revenue and is, by far, their most important product. Failure to ramp Petrifilm production would be catastrophic to the thesis.

Customer attrition. Repeated issues with product availability have opened the door for competition and created share loss. There may be a snowball effect if NEOG’s brand is damaged.

Personnel Attrition. Mismanaged merger integration has created personnel attrition. The loss of key 3M scientists and engineers may create headwinds for successful production rollout and weaken the firm’s sales and marketing capabilities.

Catalysts

Growth unmasked. NEOG’s core business is growing at mid-single digits, which is obfuscated by operational and macro issues. We believe alleviation of these issues will drive a material re-rate in the stock.

Strategic divestment. Animal Safety divestment should help catalyze the story, as proceeds can be used to buy deeply discounted stock or deleverage.

Post-merger renormalization. NEOG requires significant restatements to evaluate today. The roll off of capex, one-time charges, and other merger-related complexities should encourage more investors to get involved.

Conclusion

NEOG is a hairy story requiring extensive restatement of financials and deep qualitative research. Underneath the hair, we think the NEOG quality growth story remains intact despite significant challenges. There are multiple smoking guns in earnings transcripts and revenue sub-accounts that, contextualized with expert interviews and discussion with management, provide sound evidence of NEOG’s operating strength. Even if we are wrong about NEOG's ultimate growth profile, downside appears limited, given that the business can overcome near-term merger integration hurdles.

Further, the idea appears deeply asymmetric. Even in a highly punitive scenario where growth flatlines and multiples remain depressed (as outlined in our bear case), the stock still only represents c.20% downside. Meanwhile, a return to more normal multiples and growth implies several hundred percent upside!

NEOG fits into our favorite bucket of stock ideas: Highly researchable, well catalyzed in the short term, and high probability of converting into a long-term buy-and-hold.

Please leave any feedback, comments, or pushback in the comment section. You can also find me on X @cornerstone127. Write-up suggestions welcome!

If you enjoyed this and want more of this type of content, please subscribe below. Also, be sure to share with friends, family, and colleagues. Thank you for reading!

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your own due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclaimer: As of the time of writing, the author owns shares in the company described in this article. The author may purchase or dispose of these shares at any time without notice.

Thank you.

1. This section appears twice "Operational Missteps

3M refused to transfer its FSD ERP system to Neogen, meaning NEOG needed to set up its own system before bringing manufacturing and distribution of FSD in-house..."

2. How do you think after the latest news?