A Year In Review

Reflections on how we did, comments on style, and plans for the new year...

Hello Cornerstone Value subscribers 👋 Happy New Year to all of you, and I hope you all had a wonderful holiday season. Let me start by thanking all of you for your support and readership in my first year of writing here. When I started this project last January, I had no idea the level of popularity it would garner. Frankly, I just wanted an outlet to publish my ideas and share them with like-minded investors.

I never would have imagined that Cornerstone Value would garner nearly 500 subscribers, 750+ followers, and over 5,000 unique readers across just shy of twenty articles, all in its first year. I’ve had a great time writing and enjoyed interacting with many of you over the year.

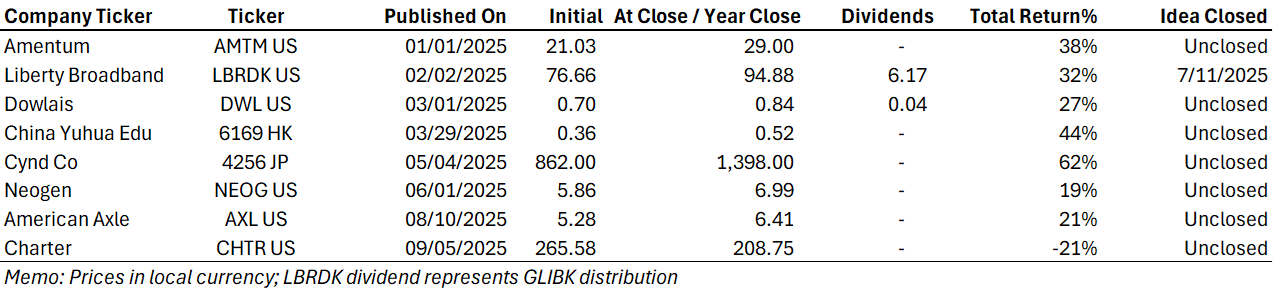

I’m happy to say performance on the posted ideas has also been quite strong.

How did we do?

Of the eight ideas we wrote up, only one lost money by the year’s close (Charter Communications). With regard to Charter, we remain unconcerned by recent downside volatility, given robust fundamentals and several 1H26 catalysts still playing out. We think CHTR is likely to be a bit of a slog from Point A to Point B, given current unpleasant competitive dynamics, but valuation is a coiled spring, sell-side remains bearish, and the Cox merger provides upside to consensus figures in our view.

One idea (Liberty Broadband) played out in full through the year with excellent results. Interestingly, a month or so later, we were right back in the name, this time on price dislocation in the underlying (Charter). It's also worth noting that the Dowlais position is effectively closed, given its pending merger with American Axle, which we expect to be fully approved in 1Q26. We retain our shares and hope to roll the position into American Axle equity soon.

Other top ideas for us (Amentum, Neogen, CYND) delivered market-beating results, but remain well off our price targets with several near-term catalysts and what we view as strong fundamental underpinnings supporting the businesses. These positions remain open, core holdings for our personal account, ultimately making up the lion’s share of our portfolio value today.

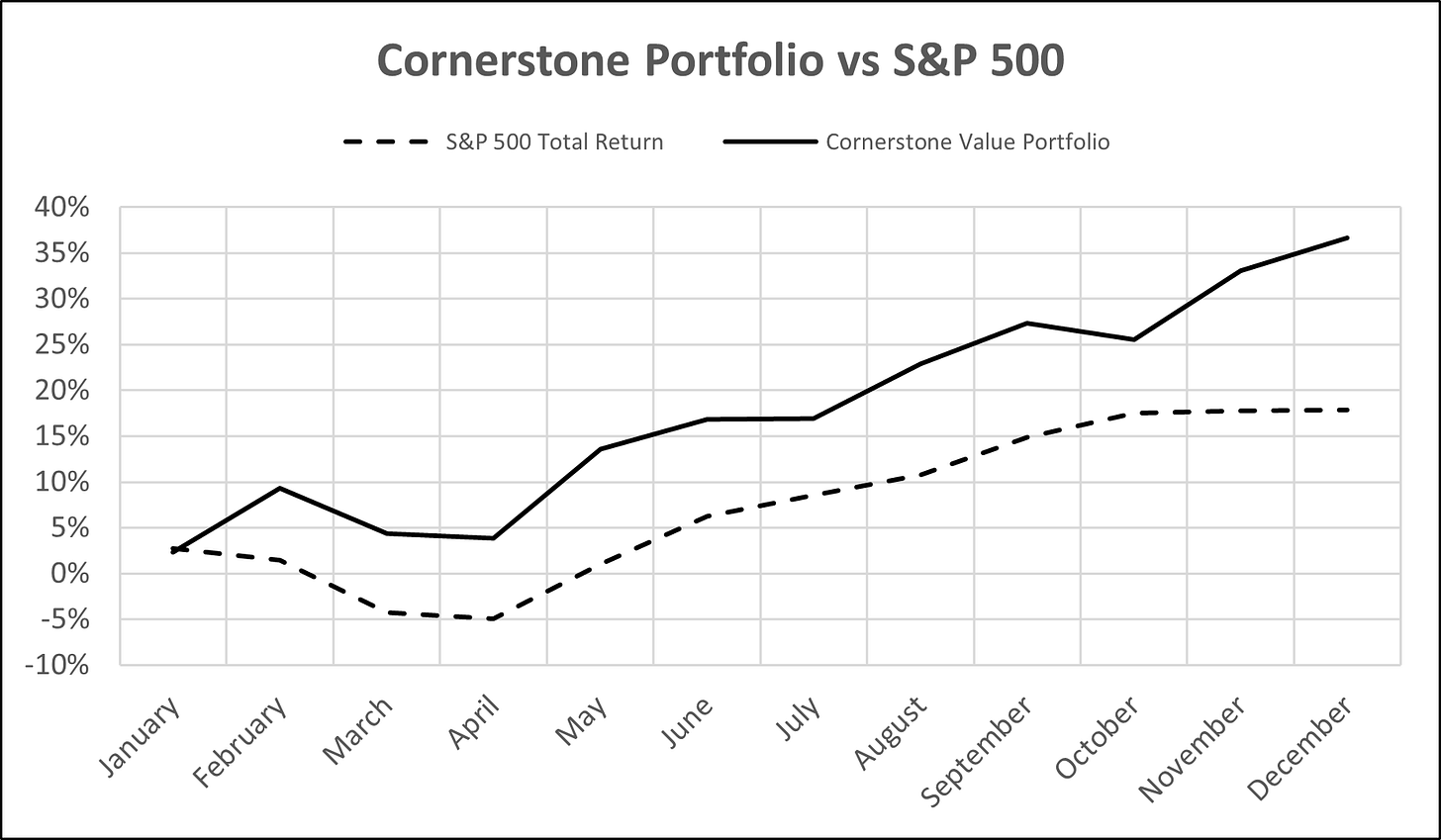

We underwrote a wide range of interesting small-cap special situations this year, and we’ve been very pleased by the reliability of the alpha pool in these investments. Volatility in individual stocks was at times high, but constituents have remained largely uncorrelated with one another and with the broader indices. The net result has been consistent month-to-month returns with below-market volatility. This is precisely the outcome we want to see in our basket: downside-protected, fundamentally robust, and catalyst-rich stocks that can generate reliable returns, largely independent of market forces.

One thing that pleased us throughout the year was the number of positions that worked for “the right reasons” (as opposed to for unforeseen or unpredictable causes). Generally, we’ve entered each position with a defined variant view and catalyst timeline supported by measurable data, and this analysis translated well into the real world.

Style adaptations → Becoming better?

This past year, I’ve thought a lot about how we (broadly, value investors) and I (as a guy who just wants to extract a reasonable return from the market) should behave to maximize our odds of beating the market. To this end, I had several formative experiences throughout the year with brilliant investors largely outside of my typical circle of “value investors.” I’ve sought to absorb best practices from these groups, building a long-term meta-philosophy of “How to Invest” (whatever that really means). I’ll share a few shifts in my mindset as a kind of open journal of my own learning. To be clear, I have no doubt whatsoever that I still have many, many more formative experiences ahead, and perhaps by the “2026: Year In Review” article next year, I’ll have dropped or changed some of these things entirely. Such is investing.

Modelability. Although I have difficulty aligning with the short-term nature of “the pods1,” I’ve now seen enough examples of their work to be firmly convinced that their obsessive modeling is an enormous advantage in any modern investing framework.

As such, I spent a significant amount of time rebuilding my models using “pod best practices.” Building these models is a bit grueling, and I understand why many investors don’t do it, but my experience has been that it does provide an edge.

Even if modeling yields no edge, it may not be avoidable in today's market. Many of our competitors are building detailed models with KPIs at a high level of granularity. If we don’t have that level of detail, are we just structurally disadvantaged? It seems likely so.

Measurability. Another “innovation” in my process has been a growing focus on thesis measurability, e.g., KPIs derived from the business or sourced from secondary data, which provide a clear image of the underlying operating health. I’ve become highly reticent to invest in stocks where I can’t define and measure a basket of KPIs beyond revenue and margin growth.

Although we now know many of the Tiger Cubs of recent years were beta-surfing, the “O.G.” fund, Tiger Global, and its founder, Julian Robertson, truly revolutionized equity research decades ago with their focus on measurability and obsession with key drivers.

Many value stocks carry amorphous risks. In a few years, something will change, or a cloud will lift. But how do we measure something two years away? When has the thesis crept or the dynamic changed? As Tetlock discusses in his book Superforecasters, forecasts need to be (a) measurable and (b) time-constrained.

Tiger Global did a fantastic job applying Tetlock's principles (on accident, it seems), and I think this was to their extreme benefit. If I find a stock that is “unmeasurable” or lacks defined time parameters, it's a hard pass.

There are many, many ideas available to us. We may as well pick ones where we can be definitely wrong rather than in the dark with dead money or worse, blindsided by immeasurable risk.

These two principles, measurability and modability, are closely linked. When I sit down and evaluate a stock today, my immediate goal is to estimate (a) What will cause this stock price to go up? and (b) How will I measure if that event is more or less likely to occur over a definable period? We can then embed our measuring sticks into our model and quickly re-evaluate our thesis at explicit periodicities, continually testing the claim we initially made.

This isn’t short-termism; it's prudent, formal analysis. In fact, I would argue that the longer the thesis, the more critical it is to have reliable, frequent, and well-defined core drivers. Why? Because predicting something five years from now is basically impossible. We need to granularize our data into increments whose sum total produces a five-year forecast; this way, we can catch early warning signs of error.

These aren’t vast insights into how to evaluate stocks, just simple adjustments that I’ve made to my own process throughout the year.

Broad account performance

Although it may have little bearing for readers and I have no intention of providing “receipts” to verify results, I will take some time to write about my personal performance for the year. This blog is as much an open journal of my journey learning in markets as a service to readers, and I am a big believer in performance tracking, so the first weekend in January tends to be jammed with analytical work on my aggregate personal holdings.

In short, 2025 was quite a strong year in the personal account. Names published here did well, but we also had several unlisted names that performed exceptionally, delivering returns in excess of 50%+. Moreover, many of the ideas presented here had multiple shots on goal, particularly for the highest conviction ideas, namely Neogen and Amentum, and trading around this volatility contributed meaningfully to full-year returns.

Portfolio performance outpaced any reasonable benchmark. We generally compare results to the S&P 500 for simplicity, but one could argue the ACWI or RUT are better comps; regardless, we delivered >1700bps of outperformance against all three. Importantly, our correlation with any underlying remains relatively low, and beta is sub-1x.

I am pleased to report that we found no meaningful correlation with core factors (value, market cap, momentum, etc.) beyond pure beta, which accounted for a de minimis ~25% of the variance (R^2). Meanwhile, the book continues to compound at well above market rates across the 3-year, 5-year, and lifetime horizons. This should indicate strong alpha returns, not just slinging levered beta.

One final key figure I track is up/down capture ratio. Three-year trailing capture capped 2.0x at year-end (1.05/0.52). This is much better than the lifetime capture ratio of 1.6x (0.83/0.51), and we expect the three-year figure must degrade over the coming years. Still, our overall takeaway is that we are seeing <60% downside risk relative to the market, and that protection isn’t costing nearly as much on the upside.

We continue to run a highly concentrated book, with Top 5 positions generally accounting for >50% of the portfolio and Top 10 positions accounting for >90%. We’re entering 2026 with greater concentration than in years past; Top 5 positions account for c.70% of the book.

We tend to think about the book in terms of practical exposure, which is now 7.5x (HHI). This is partly a reflection of the opportunity set and partly a reflection of high conviction in what we view as deeply asymmetric (theoretically) low-risk setups.

We’ll close this missive by noting that markets ripped following the April 2025 tariff drawdown, even though little risk actually seems to have shaken out of the system. As such, we’re approaching 2026 with caution. Our goal is to drill deeper into idiosyncratic positioning, with the general thesis that equity market beta may not be our friend in the coming year. We think readers would do well to view the boom in finance substacks, fintwit, crypto, meme stocks, and retail-driven activity as a bearish flag, potentially portending a reset in equity valuation.

Cornerstone Value Going Forward

A lot has happened over the last year. I feel that I’ve grown significantly as an investor (in no small part from the reps writing for all of you!), but the pace of ideas posted here needs to slow and, in fact, already has. There are several reasons for this.

First, I want ideas posted here to remain high personal conviction where I’m eating my own cooking; i.e., I bear substantial personal risk on each idea I write up. This has been a great year for new idea generation, but not every year will be as fruitful, and new idea turnover in my account is relatively low. On top of this, in today’s expensive market, it feels there are fewer good, truly alpha-generating ideas than in years past.

Second, life has gotten busy for your author. I’ve taken on more responsibilities at work, I’m ramping up my recruiting efforts, and I’d like to get more involved in networking circles like VIC or MOI Global. What does this mean for Cornerstone value? Probably lower deep dive velocity in the coming year. If I post 3-6 great ideas in 2026, I’ll consider that a success.

That doesn’t mean the number of articles will reduce much. Expect more thought pieces, discussions of my own philosophy of investing, and multi-part deep dives into existing positions such as CYND, Charter, and American Axle to round out roughly quarterly deep dive posts. I think this strikes the right balance between offering an interesting platform to discuss how I think about investing and providing high-quality, value-added insights to readers.

And that's all from me, folks. Thanks again for reading, and happy New Year to all of you. Let’s hope the market treats us well this year.

Please leave any feedback, comments, or pushback in the comment section. You can also find me on X @cornerstone127. Write-up suggestions welcome!

If you enjoyed this and want more of this type of content, please subscribe below. Also, be sure to share with friends, family, and colleagues. Thank you for reading!

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please do your own due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclaimer: As of the time of writing, the author owns shares in the company or companies described in this article. The author may purchase or dispose of these shares at any time without notice.

Citadel, Millennium, Point72, etc.

The shift toward modelability and measurability really stands out here. A lot of value folks still lean on qualitiative narratives rather than KPI tracking, but framing thesises with explicit time windows and quantifiable drivers (like Tetlock's forecasting principles) seems smarter long-term. One observation though: your concentrated book (70% in top 5) paired with 7.5x HHI implies heavy overlap or sizing risks. When positions like CHTR hit volatility despite solid fundamentals, how do you balance conviction against the psychological strain of carrying outsized exposure during extended slogs?