Charter (CHTR.US): Backbone Infrastructure At A Steep Discount

Inflecting cashflows, pending merger, and intense quarterly volatility. Scooping up dominant infrastructure for a 10%+ yield.

Note: We initially traded into LBRDK as an event-driven play but sold post-spin. Today we are back to the table with a fundamental pitch on the underlying (CHTR). Despite focusing on CHTR, we've chosen to own LBRDK to capture the pending 4% merger spread. Despite owning LBRDK, we decided to title the write-up as CHTR, given that LBRDK is now a virtual proxy.Base Case & Quick Notes

Charter Communications (“CHTR”) is the second-largest provider of broadband internet in the U.S., with ~26% market share by subscribers.

CHTR controls vast swaths of critical infrastructure across the U.S. that would cost tens (perhaps hundreds) of billions to replicate.

The consumer internet market is in turmoil post-COVID, as it experiences the largest secular shift in market dynamics since cable displaced DSL in the 1990s.

Despite secular shifts, we believe cable infrastructure will remain the dominant form of internet as we reach a new equilibrium.

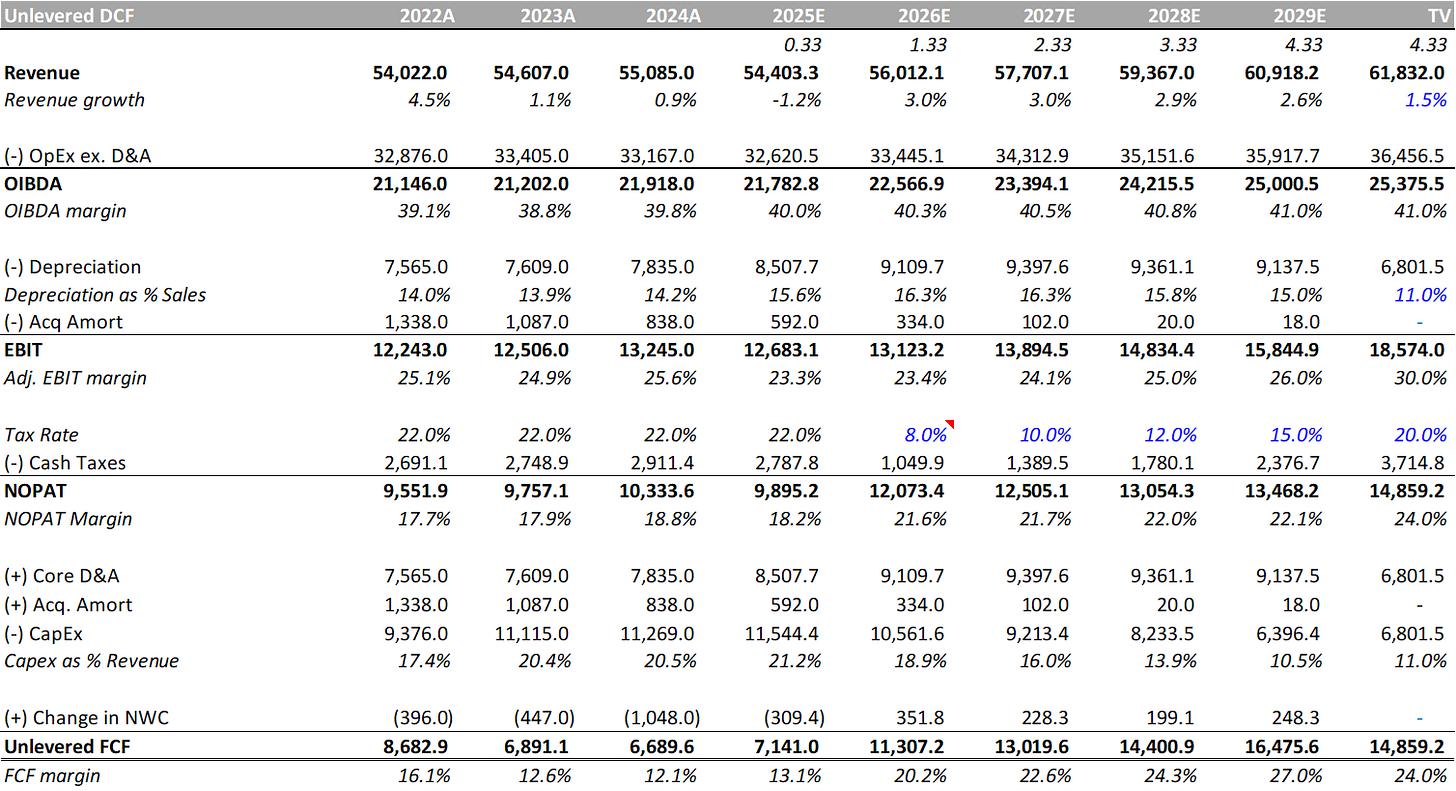

At today’s price, CHTR’s phenomenal utility-like asset base is selling for <10x FCFF even before accounting for a pending merger, back-cycle earnings, and more.

Thesis Summary

Charter Communications (“CHTR”) is the second-largest high-speed internet provider in the U.S., serving c.26% of consumers nationwide. Historically, an attractive MSD% grower with monopolistic regional positioning, CHTR’s competitive edge has recently come under scrutiny due to a series of cyclical and secular issues, which have driven a protracted re-rate in the stock.

Charter’s current valuation implies a meaningful extension of recent (mostly subsidy-related) subscriber losses, which seems unreasonable when examining the competitive environment. Competition clearly points to moderation in growth going forward, but CHTR is priced well beyond moderation; the stock is priced as if it were a cigar butt.

At 9x Core FCFF and 6.5x P/E, we believe CHTR presents an extremely attractive r/r ratio against our base case of broadband stabilization. Moreover, we see a clear path to inflection over the next 12 – 24 months as broadband net additions stabilize, capex inflects lower, and CHTR returns to aggressive buybacks. Further, we believe that additional upside will be injected into our model through the recently announced Cox merger (pending regulatory approvals).

Recent Events

December 2021. FCC introduces a broad subsidy program, the Affordable Connectivity Program (ACP), for broadband internet.

June 2024. ACP subsidies officially end, setting up extended broadband churn in Charter’s subscriber base.

November 2024. Charter ratifies an all-stock deal to acquire Liberty Broadband, aiming to simplify its capital structure.

May 2025. Charter announces Cox Communications merger. Deal still pending approvals.

Why Does This Opportunity Exist?

Competitive Uncertainty. For decades, Charter’s Hybrid Fiber Coaxial (HFC) infrastructure was the dominant form of broadband, operating as a regional monopoly wherever it was deployed. New competitors FWA and Fiber have challenged HFC, adding significant competitive pressure to previously monoplistic markets.

Abysmal Sentiment. We’ve universally heard that investors have chosen to sideline themselves regardless of valuation until broadband subs begin to inflect and sentiment turns. Charter is among the most hated stocks in the S&P 500 after its precipitous multi-year downturn.

Technical Dynamics. Charter has neatly come into the crosshairs of the increasingly important long/short equity pods1. Pods can cleanly trade quarterly net broadband additions and pair the stock against near-peer Comcast. This has created massive volatility around earnings revisions and quarterly prints.

Business Background

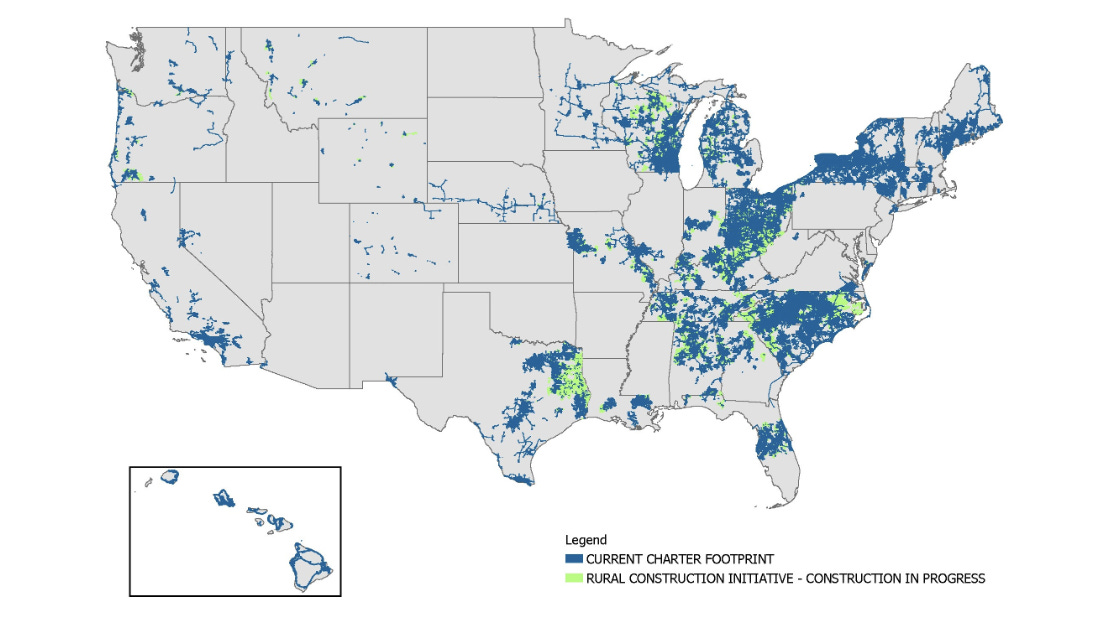

Charter serves 31 million+ consumers and businesses with cable TV, broadband internet, landline, and wireless services. Charter’s footprint spans 58 million passings across many major hubs, primarily in the Eastern and Midwestern United States. A high-speed internet behemoth, the firm is only outstripped by Comcast’s Xfinity (28% share). Below is a brief description of core business lines:

Internet (43% Sales): High-speed internet services through a blended hybrid-fiber coaxial (HFC) and fiber to the home (FTTH) network. By far, Charter’s most important segment. Although the company doesn’t provide segmental profits, we estimate that Internet services account for the vast majority of earnings today.

Video (25% Sales): Charter’s cable TV business still accounts for a substantial portion of sales, but is an immaterial profit center. Disclosed programming costs imply a stable 35% GPM, while our pro-forma OpEx allocation indicates ~0% EBIT margins. Video services are almost entirely variable cost, allowing for an orderly winddown of the service as it inevitably declines. Video services are maintained primarily to reduce churn.

Wireless (6.5% Sales): In 2018, Charter launched Spectrum Mobile, a discount mobile service, through an MVNO relationship with Verizon. Today, Spectrum Mobile is the fastest-growing mobile network in the U.S. and the primary driver of growth for Charter. Historically a loss leader, mobile's EBITDA has turned positive in recent quarters and is expected to scale meaningfully from here.

Charter also generates revenue through landlines, advertisements, mobile device sales, and business customers (aggregate ~20% of revenues). Overall, these services are not significant profit or growth centers.

One of Charter’s main selling points is its “converged” offering, available through its Spectrum One package, which bundles entertainment, internet, and mobile services at a significant discount compared to purchasing each service separately. Bundling reduces churn, significantly improves CHTR’s customer LTV, and drives better total ARPU per relationship. Charter is the market leader in convergence and maintains that its converged offerings are a competitive advantage.

History of cable and evolving landscape

The cable industry has a complex and often misunderstood history. Cable infrastructure was initially laid in the 1960s and ‘70s to deliver TV to the home, but shortly after the internet emerged, the coaxial network was repurposed as a high-speed competitor to DSL. By the 2000s, cable had become the standard for consumer internet, as it was faster, more scalable, and more convenient than any other form of transmission. Fast forward to today, and, while many of us still think of cable companies as declining Pay TV media firms, CHTR and peers now primarily focus on internet delivery, earning only minimal profit from their legacy operations.

Unlike the now-dying cable TV business (which receives disproportionate press fanfare), CHTR’s broadband business has long enjoyed secular growth as data consumption has grown exponentially. Moreover, the business is enviably moaty, as Cable operates as a regional monopoly with excellent incremental margins, robust pricing power, and (until recently) ample opportunities to add new marginal subscribers through network buildout and increased penetration. Cable internet growth has been so strong, in fact, that Charter has delivered decades of consistent MSD% growth at accretive incrementals, even as its cable TV business shrank.

Unfortunately for Charter, post-COVID, broadband dynamics began to shift dramatically. In 2021, Verizon and T-Mobile launched and scaled value-oriented competitor networks via “Fixed Wireless Access (FWA)” by leveraging unused spectrum to deliver 5G internet to homes. Contemporaneously, “fiber overbuilders” (legacy DSL companies replacing copper networks with modern fiber) became increasingly aggressive in building “the network of the future” (seemingly without regard to their own economics). The introduction of FWA and fiber converted many historically monopolistic markets into triopolies, adding competition to an industry that previously faced none.

FWA and Fiber have compellingly attacked Charter’s subscriber base from opposite ends of the value spectrum. FWA is slower and less reliable, but it provides an excellent value proposition for price-conscious consumers ($30/month). By contrast, Fiber is a faster network offering speeds of up to 5/5 symmetric (and beyond), and is marketed as a premium internet connection. Both FWA and Fiber have attracted significant market share at the cost of HFC growth.

Market competition in numbers

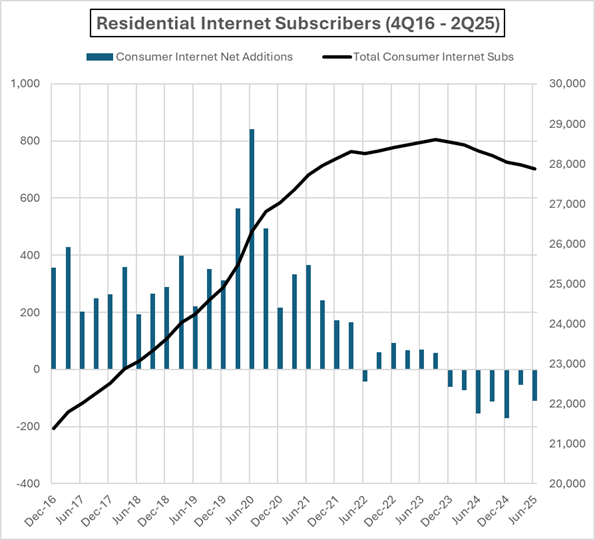

We can clearly see the competitive story play out in the chart above. Pre-COVID, broadband adoption progressed predictably, adding incremental subscribers as more consumers required broadband and rural buildouts gradually replaced residual DSL customers. In COVID, this trend markedly changed.

FY2020: We witnessed a dramatic pull-forward in broadband subscriptions, driven by WFH mandates and a massive broadband access subsidy, known as the Affordable Connectivity Program (ACP).

FY2021: ACP-related pull-forward and beginning ramp of FWA created a modestly weak year for net additions.

FY2022: Net additions plummeted in 2H22. The broadband market finally reached saturation. Net additions in broadband disproportionately moved to FWA as consumers felt the pinch of inflation. Meanwhile, fiber became a more significant competitor, aggressively leveraging cheap debt to expand its infrastructure.

FY2023: Broadband struggled to add subscribers in the face of increased competition. Growth had obviously slowed, and FWA continued to win the rural war for incremental additions.

FY2024: For the first time in cable’s history, net additions turned sustained negative. Increased competition stifled growth, but the expiry of the ACP drove losses. Previously subsidized consumers flocked to FWA.

In 2025, we’ve seen a continuation in net losses from the ACP expiry. While many subs churned early, others remained on CHTR’s network as non-paying customers. As we fully lapped ACP expiry in 2H25, we’ve seen an increase in forced churn.

Fundamentally broken or myopic sell-off?

Against the current competitive backdrop and declining subscribers, investors are now questioning whether CHTR and its peers are fundamentally broken companies. We believe the answer is a resounding “no,” with the conviction that forward sentiment and multiples are far too low. We will address why we think FWA and Fiber are not going to “kill” HFC individually.

1. Will Fiber kill HFC over the long term?

One concern investors raise is that Fiber is a cable killer. Fiber offers faster symmetric speeds than HFC and has greater ability to scale in the future. The tech has captured significant (c.40%) market share wherever available. Consumers of all ages are aware that fiber is faster than legacy infrastructure, and fiber companies have actively marketed themselves as the premium/futuristic option to great effect.

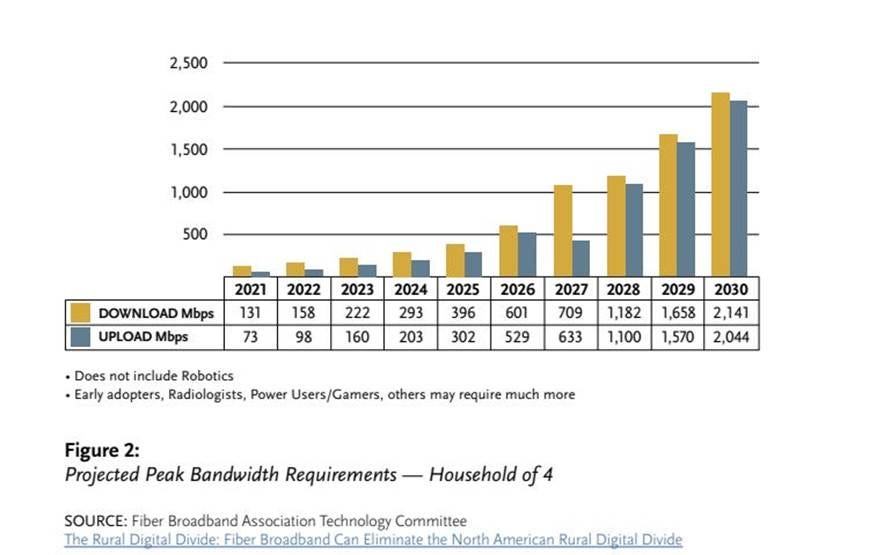

What many consumers don’t realize is that Fiber’s enhanced speed is almost universally irrelevant. Below, we provide a graphic from an FBA whitepaper, citing that the average family of four today only needs ~400 Mbps down (barely better than an FWA connect). Beyond this speed, most of the extra bandwidth available is effectively wasted.

Even looking well into the future, data demand is unlikely to exceed 10 Gbps for the average household in our lifetime, rending Fiber’s ability to scale to "100/100” irrelevant. Crucially, current HFC infrastructure already delivers speeds well beyond consumer needs (1 Gbps in most of the footprint). But even this is only a starting point. Legacy network speeds can be scaled at a relatively low cost by deploying modern protocols (DOCSIS 4.0), which will ultimately move cable to 10 Gbps down across the network, far beyond any reasonable expectation for demand over the coming decades.

2. Is FWA the future? Will it continue to absorb the majority of net additions?

Ramp in FWA has astonished market participants since its emergence in 2021. Both telcos and cable companies underestimated market demand for value-seeking broadband customers. Furthermore, demand clearly continues to be unmet, as evidenced by rapid net additions. AT&T’s purchase of SATS’s spectrum is a clear bid to get aggressive in the space. Meanwhile, T-Mobile and Verizon’s solutions show no signs of slowing down. Ultimately, though, there is a reasonable limit to FWA market share, both due to spectrum constraints and consumer preference.

FWA necessarily trades off speed and reliability for price. Moreover, in urban environments, network congestion reduces usability in peak traffic times. FWA satisfies specific niches in the market, such as rural consumers transitioning from DSL, price-sensitive urban consumers, and non-family households with low bandwidth requirements. FWA is, however, inadequate for larger families or those that need or prioritize network reliability at home. As a general rule of thumb, those who can afford the modest marginal cost for a better internet experience will happily pay that cost.

On the flip side, the supply side of FWA is finite. Selling spectrum as FWA is an inefficient use of limited spectrum assets by the telcos. FWA’s uptake has been limited due to the mass of unused spectrum in Verizon and T-Mobile’s networks, which incentivizes the “wholesaling” of the dead spectrum. In other words, almost regardless of long-term demand, FWA will eventually cap out the amount of spectrum reasonable to use on the service.

We haven’t reached equilibrium in FWA yet, but we can take solace in the fact that we must reach equilibrium sooner or later. Both supply and demand are necessarily finite.

3. Why do expectations reflect dire straits for Charter?

Sentiment may have never been lower in the cable space. CHTR’s stock has cratered as competition entered, whipsawed wildly for two years now, and left many long-term cable bulls disappointed. Many would-be buyers have been burned too badly or are currently bag-holders in size (Harris Associates, Dodge & Cox, and more). The last quarter's miss in expectations, coupled with a seeming total lack of awareness by management, shook investor confidence at a time when confidence was already on thin ice. Taking a step back, however, we see a significant disconnect between the tangible narrative and current multiples.

Charter is priced at 6x consensus forward earnings, implying cigar butt territory. Meanwhile, fundamentals paint a very different picture. Capital intensity is about to moderate significantly as recent edge buildouts and network upgrades subside. ACP roll-off is one quarter away from being completely worked out of the system, which will put net additions into ~flat territory y/y in 2026. Competition remains rational from the telcos as the industry still remembers pain from the T-Mobile price war years ago.

For reasons outlined above, we believe HFC will remain the dominant form of broadband, although the days of a 60%+ market share and consistently high growth are gone. Finding equilibrium is going to take time (1 – 2 years), but we’ll see re-rates in the stock well before we reach stability. In the interim? Charter is a cash machine, consolidating the #3 players, and only a few quarters away from flipping from investment cycle to capital return cycle. Too many investors have been burned for too long for the market to be acting rationale.

Cox Communications Merger

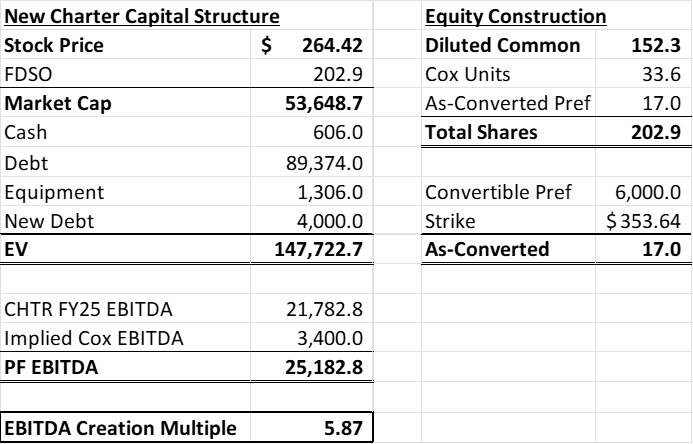

Given the competitive backdrop and pressure that legacy cable is now facing, Charter and Cox have proposed a cash-and-stock merger that will catapult Charter to #1 market share post-merger (32% pro-forma). With merger markets now seemingly wide open and the FCC more supportive of consolidation than ever before, we, along with most telecom pundits, believe the merger will close without issue. This case is further strengthened by the fact that Cox and Charter’s networks are non-overlapping, and Charter intends to reshore a significant number of jobs post-close, pursuing an explicitly “America first” messaging strategy.

We believe the Cox combination makes tremendous strategic sense for Charter from both a valuation perspective (pre-synergy, only 6.44x EBITDA for the enterprise) and a strategic growth perspective. Cox has ~12m passings with 5.6m internet subs but no meaningful mobile subscribers. Charter, meanwhile, has the fastest-growing mobile network in the U.S. with strong cross-sell on their internet products. Shifting to more converged customers will naturally reduce churn and increase ARPU across Cox. While CHTR hasn’t outright said this is the plan, we think it’s telling that Charter’s press release and investor presentation repeatedly placed mobile as the first product listed, despite mobile only accounting for <5% of the combined entity’s revenue.

We estimate the Cox mobile opportunity at $1 - 2b in mobile revenue, based on a $20 - $30/line/month and a 30-50% run-rate penetration. Assuming mid-point on our estimates, this implies a post-synergy multiple <6.0x EBITDA. Even lower when accounting for the recent decline in the CHTR equity component, with the implied multiple now approaching 5.0x EBITDA on today’s prices.

Idiosyncrasies in the modeling obfuscate true economics

Capital structure adjustments

Charter’s capital structure is complex. The following items need to be adjusted to accurate portray the stock.

Advance/Newhouse (A/N) received Common Units instead of Common Stock in the 2016 TWC deal. GAAP accounting classifies this as NCI and excludes units from the diluted shares. We convert the units to a common and remove the NCI to correct the distortion.

CHTR carries a significant deferred tax liability that is unlikely to reverse. Two-thirds of the liability is related to a step-up in basis resulting from the TWC merger, only reversible in liquidation. The balance is TCJA bonus depreciation, which will no longer reverse due to the passage of the OBBBA.

Charter’s pending merger with Liberty Broadband (LBRDK) will decrease shares outstanding by ~9.3m and increase debt by $2.2b.

Liberty Broadband Merger

Charter entered a definitive agreement to merger with LBRDK in an all-stock deal that roughly amounts to a levered share buyback at a modest discount to market value. The mechanics of the deal are well covered in our prior article.

The initial timeline on the LBRDK deal was June 2027, but this has been accelerated in light of the Cox merger. LBRDK will fully merge with Charter prior to the Cox closure, once regulatory approval for the Cox transaction is obtained.

Given all this, we prefer to own LBRDK versus CHTR as a means of capturing the modest 4% merger discount currently in play. We believe it is extraordinarily unlikely that the deal will not close.

Cox Merger

Structurally, Charter intends to assume Cox’s name (seemingly a nod to the Cox family's interest in their legacy), but will retire the Cox cable brand in favor of Spectrum (this makes sense as Spectrum is a household name while Cox is not). The deal is structured as $4b in cash, $6b in 6.875% convertible preferred, and 33.6m common units. On a fully converted basis, the Cox family will own 23% of Charter pro forma.

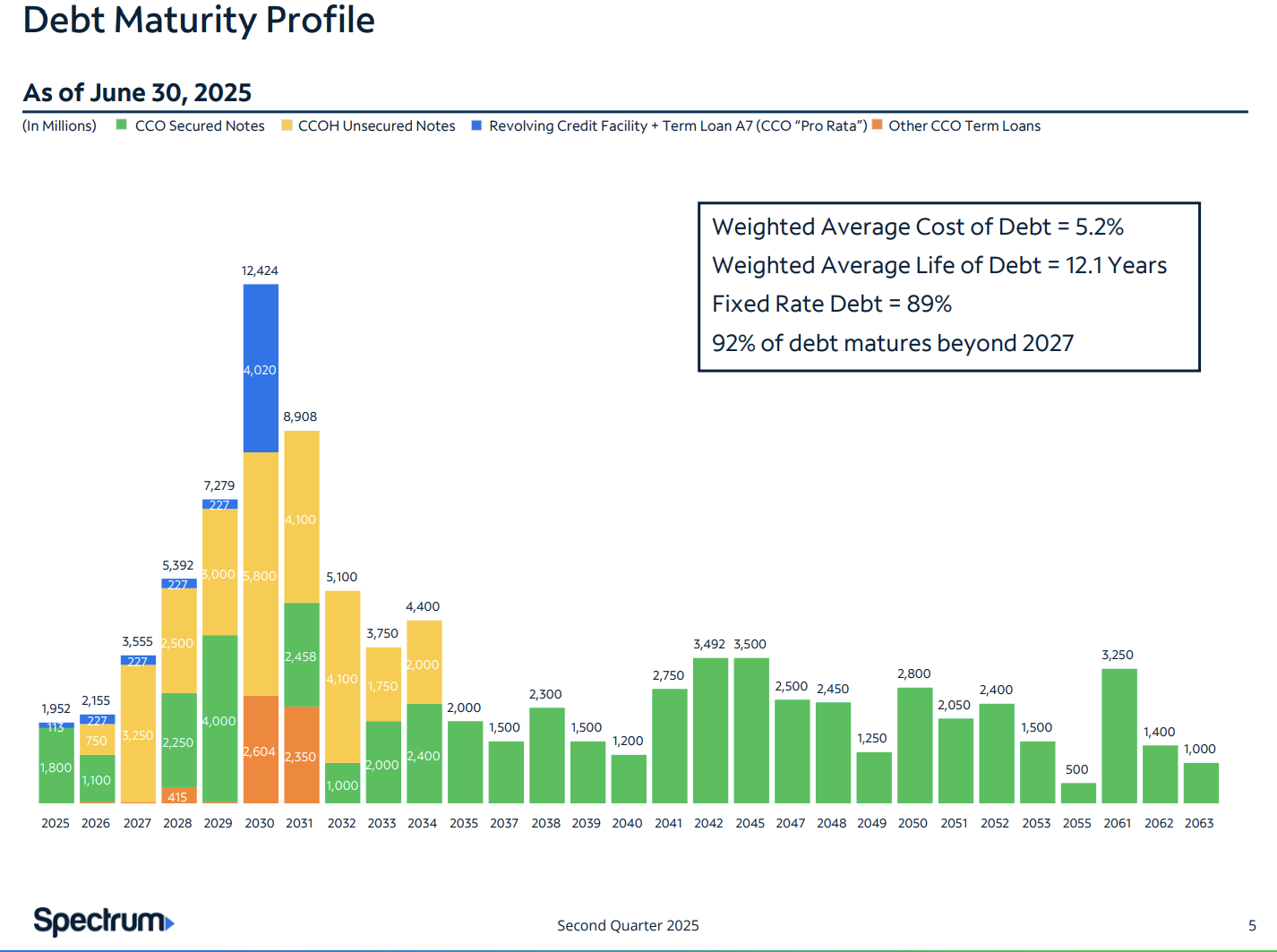

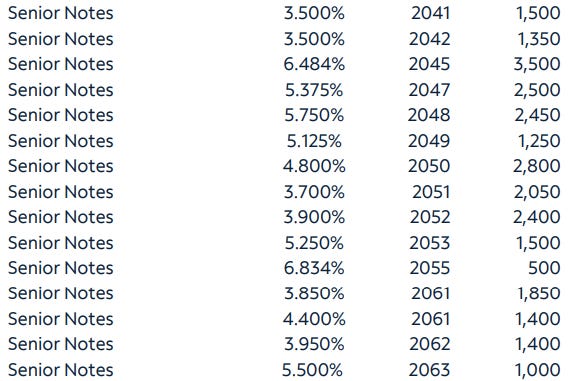

Phenomenal Debt Stack

A unique and perhaps underappreciated aspect of the Charter capital structure is its long-dated and low-rate capital stack. The majority of Charter’s debt (89%) is fixed-rate with a WA interest of only 5.2%. This debt acts as an asset to shareholders as duration significantly lowers the value of the debt stack. We value Charter using the Level 1/2 fair market values of the debt to capture this benefit. Below we’ve snipped the 2040 and onward fixed rate maturities (par value on far right):

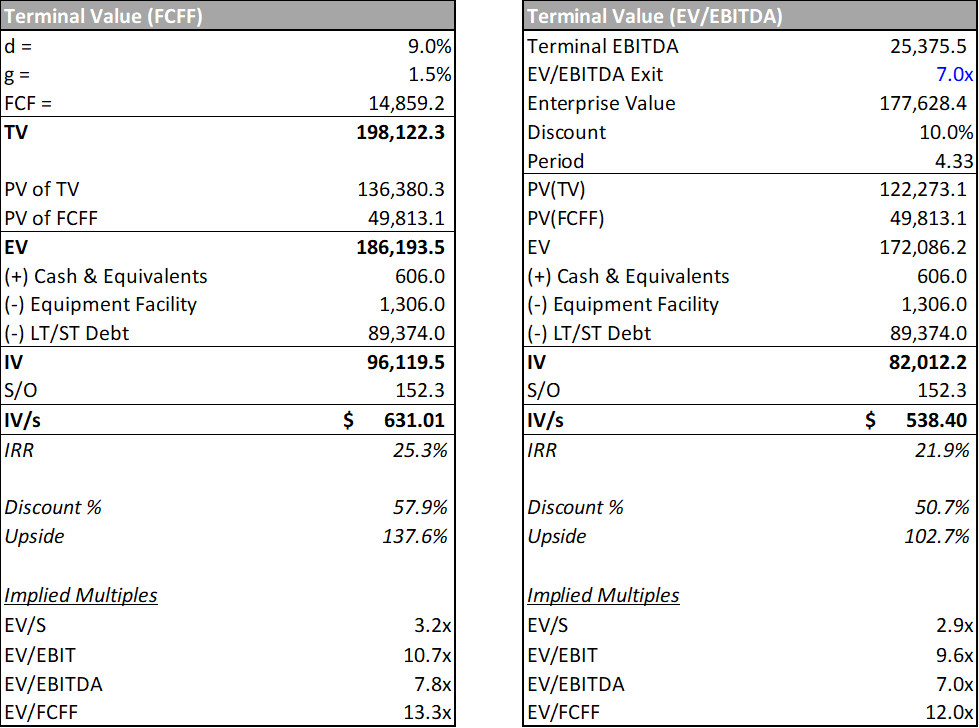

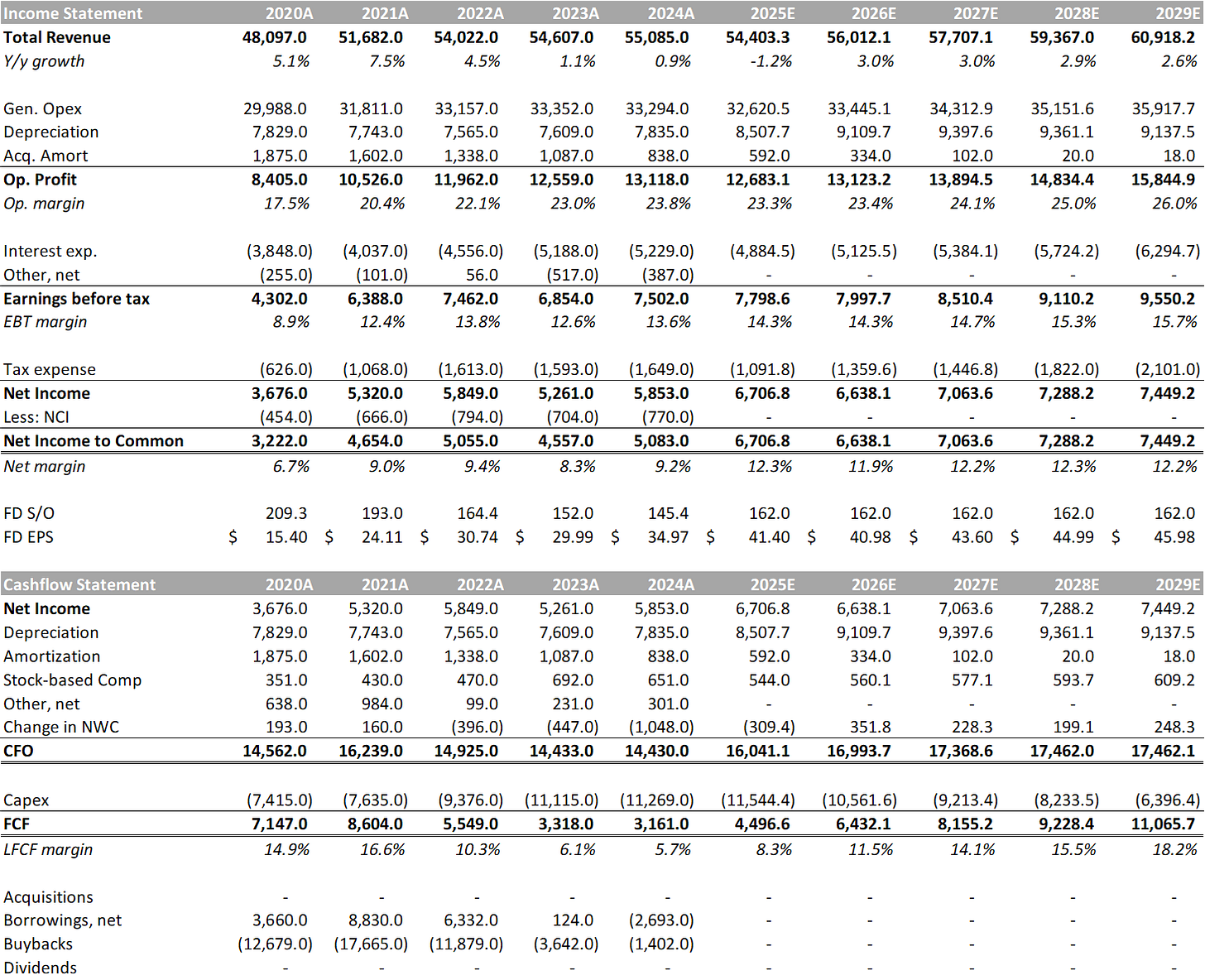

Valuation

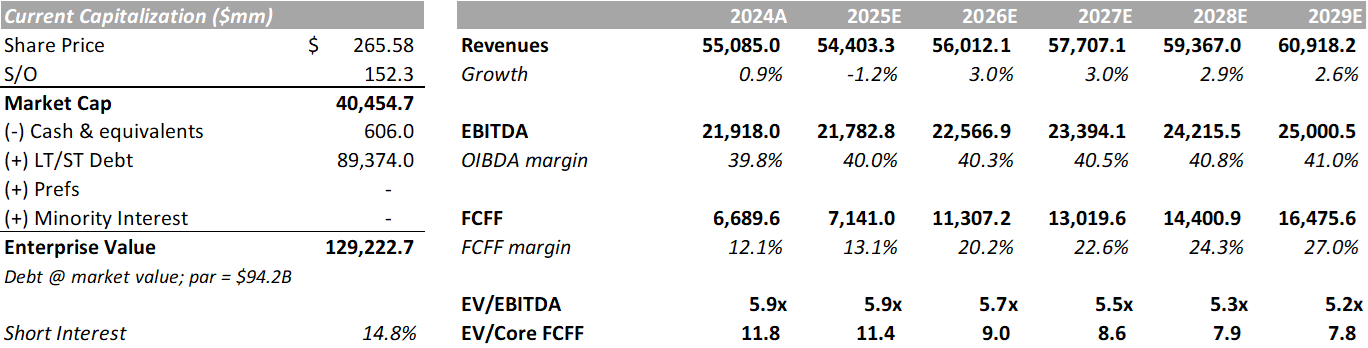

Note: Our base case, as outlined here, does not account for the potential benefit of the pending Cox merger. It does capture the pending LBRDK capital structure shift and the impact of the OBBB on Charter’s financials.

Summary Financials

Key Risks

Competition. Our base case, as outlined, suggests that:

(a) FTTH will not be competitive in pricing compared to bundled HFC and has no major benefit over legacy infrastructure.

(b) FWA service is inherently capacity-constrained, limiting long-term market share, and an inadequate product for most consumers.

If FWA capacity or bandwidth improves significantly (perhaps through integration with LEOs), this could erode LT broadband subs. Alternatively, if consumer demand for data advances sufficiently, then FTTH could displace HFC.

Irrational Competition. Currently, all three players are behaving reasonably. We’re seeing heavy discounting in sign-up bonuses and bundles, but no cuts to long-term pricing. If one player breaks ranks for share, we could see ARPU go into a tailspin.

Accelerated cable death. Pay-TV continues to bleed subscribers due to cord-cutting. If cable sub losses meaningfully accelerate, this could weaken Charter’s bundled value prop and increase churn. There may be more fixed costs in the cable business than we believe.

Catalysts

Net broadband subs. The key issue right now is stabilization in net broadband subscribers. As stabilization occurs, the bear thesis will break, and the stock will re-rate significantly.

Merger synergies. Sell-side is reluctant to model upside for the Cox merger due to regulatory and timing uncertainty. As the merger strategy is more clearly articulated, we expect to see marginal buyers.

Capex discipline. Moderation in rural buildouts and network upgrades is around the corner. Moderation will result in significant cash inflection and a return to aggressive buybacks.

Conclusion

CHTR remains a dominant force in the broadband landscape, a status unlikely to change anytime soon. It has been interesting to watch CHTR evolve from a competitionless monopolist in secular growth to an oligopolist in maturity. That shift has been painful and left many investors reeling, but we believe the resulting hatred of the space has opened up opportunity. Keeping a sanguine demeanor, we believe sentiment is far too low and remind investors, “it’s darkest before the dawn.” Equilibrium appears to be around the corner.

We see several ways this story can unfold. First, natural moderation in losses (and eventually a return to modest growth) in subscribers, as outlined above, will almost certainly drive a massive re-rate. This seems nearly inevitable given that most (perhaps all) of the last six quarters of sub losses were subsidy-related. Beyond stabilization, we believe the market underappreciates growth synergies in the Cox merger and the firepower Charter will bring to bear on buybacks over the next 12-24 months as capex abates.

Please leave any feedback, comments, or pushback in the comment section. You can also find me on X @cornerstone127. Write-up suggestions welcome!

If you enjoyed this and want more of this type of content, please subscribe below. Also, be sure to share with friends, family, and colleagues. Thank you for reading!

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your own due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclaimer: As of the time of writing, the author owns shares in the company described in this article. The author may purchase or dispose of these shares at any time without notice.

Pods refer to the likes of Point72 and Citadel. They are near-term traders who create market- or factor-neutral long/short positions, attempting to capture alpha spreads. Pods have become the dominant marginal buyers in equity markets. Click the link for more details on this evolving market structure.

Excellent deep dive on CHTR/LBRDK! The Liberty Broadband angle is particulary compelling - the 4% merger spread essentially gives you Charter's equity at an additional discount while you wait for the deal to close. Your point about Charter bleeding subs but still growing topline/EBITDA/EPS through 2030 is counterintuitive but well-reasoned. The converged mobile+broadband bundle is the key unlock here - if Charter hits 50% mobile penetration (vs 20% today), the churn dynamics completely change since customers are much stickier with bundled services. The Cox merger at ~6X EBITDA adds scale economies and mobile runway at an attractive multiple. Given the 10%+ FCF yield and aggressive buybacks offsetting Cox dilution, this looks like exceptional risk/reward even in a protracted fiber+FWA share loss scenario.

Fantastic write-up on Charter! There is much controversy on Charter, but that creates the opportunity (either long or short).

Bear case: broadband subscribers continue to melt --> melting cashflows + high leverage --> stock will get crushed

Bull case: broadband subscribers will stabilize / grow --> stable / growing cashflows + massive buybacks --> massive increase in FCF / share --> stock will deliver high IRR

The Cox-merger should prove to be highly synergistic (cost efficiency & mobile growth). That creates a nice downside protection, but it will take quite a bit of time to get these synergies.

2026 will be a highly interesting year for Charter.